Latent segmentation of older adults in the use of social networks and e-banking services

Ángel F. Villarejo-Ramos, Begoña Peral-Peral and Jorge Arenas-Gaitán

Introduction. This study analyses heterogeneity in the online behaviour of elderly people. Previous research has centred on the socio-demographic segmentation of the elderly regarding their Internet use.

Method. The novelty that this study adds is in determining this segmentation through variables that have been especially chosen for studies of the elderly and which are related to their utilitarian use of e-banking, compared to the more hedonic nature of using online social networks.

Analysis. The sample was collected using 474 students over 55 years old enrolled in a class of experience in a University in the South of Europe (Spain). We use a latent class cluster model which is appropriate in situations of a posterior segmentation.

Results. In dealing with such behaviour in situations of the elderly using these technologies, we have detected the presence of five groups or segments with highly differentiated use-related profiles concerning the variables analysed: venturesomeness, technology anxiety and self-confidence in information and communication technologies use.

Conclusion. We discover the existence of heterogeneity in the behaviour of the elderly regarding services available in Internet. The results support the idea proposed. The stereotype of the elderly cut off from technology is mistaken, as is shown by the different segments found.

Introduction

Throughout history technology has influenced all aspects of a person’s life, irrespective of their age. In the case of the elderly, different research has analysed the advantages of information and communication technologies (ICT) (e.g., Chen and Chan, 2014; Cresci, Yarandi and Morrell, 2010; White et al., 1999; Wood, Lanuza, Baciu, MacKenzie and Noskol, 2010). Yet, within this framework, we find little research that has tackled the use of other Internet-based applications and that can facilitate the daily life of the elderly, fostering active ageing. This concept is, according to the World Health Organization, ‘the process of optimising health opportunities, participation and safety with the aim of improving quality of life as people get older’. The term active suggests: ‘continuous participation in social, economic, cultural, spiritual and civic questions, not only the capability of being physically active’ (World Health Organization, 2002, p. 79). In the current technological and globalised environment, as is indicated by the World Economic Forum (2011, p. 109) in their Global Population Ageing: Peril or Promise? ‘ICT have a fundamental role’.

A bibliographic review concerning the elderly and information and communication technologies shows, that these users have higher levels of technology anxiety and less self-confidence than younger people (Czaja and Sharit, 1998; Dyck and Smither, 1994; Guo, Sun, Wang, Peng and Yan, 2013; Lam and Lee, 2006). Nevertheless, other studies (Agudo, Pascual and Fombona, 2012; Niemelä-Nyrhinen, 2007) carried out about the elderly belonging to the baby-boom generation (born between 1945 and 1955) showed differences with respect to this stereotype, as these elderly people have matured with the birth of current technologies and therefore have had the experience of using them.

This work means to analyse the heterogeneity in the online behaviour of the elderly by recognising different levels of technology acceptance and use. The explanation of the difference of the online behaviour of the elderly can vary between utilitarian motivation, investigated from the use of e-banking and hedonic motivation, studied from the utilisation of online social networks sites. The differences shown in the behaviour of the elderly in these two Internet applications are described by segments differentiated by psychological characteristics, such as venturesomeness, technology anxiety and self-confidence, usually used in studies of the behaviour of elderly technology users.

For the empirical development of our research, we have used a sample of elderly people who are users of e-banking and/or have active accounts in online social network sites. We have analysed their online behaviour facing both situations: 1) their normal operation with e-banking, and 2) their activity in online social network sites, exchanging and sharing information, and frequency of use. The method used is a latent class cluster model, which performs a posterior segmentation based on the results of the data analysis of the sample observed and moreover enables the identifying of the individual’s profile in each of the segments (Wilson-Jeanselme and Reynolds, 2006).

The structure of this work is as follows. First, there is a theoretical review of the main variables analysed in the segmentation model. These are both the psychological variables and the different online activities of the elderly regarding the two online platforms chosen for their utilitarian or hedonistic character. In the next section, we describe the methodology chosen and justify it as a segmentation method among users with activities that are observed a posteriori. Then, we highlight the results obtained from the sample of the elderly who are users of the technologies analysed and describe the different segments which result from the application of the latent class model. Finally, there is a section of discussion of the results obtained which leads us to determine the main implications for management, and the limitations and conclusions of the investigation.

Theoretical background

Elderly people and their behaviour in relation to the Internet

The segment of the elderly has rates of penetration of new technologies, such as Internet and mobile phones, smaller than that of the rest of the population (Peral-Peral, Arenas-Gaitán and Ramón-Jerónimo, 2013; Chung, Park, Wang, Fulk and McLaughlin, 2010; Hill, Beynon-Davies and Williams, 2008; Reisenwitz, Iyer, Kuhlmeier and Eastman, 2007). Jones and Fox (2009) find the elderly perceived the Internet more as a tool than as a leisure environment. They use technologies mainly to communicate, entertain themselves and facilitate their daily activities (Mitzner et al., 2010). Likewise, the elderly are more inclined to use technologies which are more established in the market (Chen and Chan, 2014), given that they are among late adopters of technologies and not pioneers.

The motives which explain the different level of use of Internet by the elderly, compared with younger generations, are: 1) a lack of interest, probably because they do not need to use information technologies in their daily life or do not feel social pressure to do so (Iyer and Eastman, 2006; Nayak, Priest, Stuart-Hamilton and White, 2006; Reisenwitz et al., 2007); 2) due to the negative influence of formal skills to use Internet (Van Deursen and Van Dijk, 2010); and 3) because of the difference in the need of and search for information with respect to other population segments (Dennis, Merrilees, Jayawardhena and Wright, 2009; Gilly, Celsi and Schau, 2012). Likewise, the elderly indicate that they do not use the Internet when the information and services which they need are available through traditional means, such as newspapers, telephones or the mail (Morrell, Dailey, Stoltz-Loike, Mayhorn and Echt, 2005) and they fear that adopting new technological tools can cause great changes in their daily routines (Kurniawan, 2008).

Even so, there is a significant group of the elderly involved with the Internet and who use its tools and applications and are, mostly, those who are younger within the group of the elderly (Cresci, Yarandi and Morrell, 2010; Fox, 2004; Hogeboom, McDermott, Perrin, Osman and Bell-Ellison, 2010). Thus, chronological age in the group of the elderly explains differences in their online behaviour. Fox (2004) states that the so-called silver tsunami of those aged between 50 and 64 has little to do with inactive surfers of 80 or more. McCloskey (2006) also differentiates between the elderly by subgroups of age, finding that, with respect to e-shopping, the probability of carrying out an online transaction is less for those who are older and that they also observe a greater difficulty in their use of the Internet. In general, the probability of commitment to the Internet is reduced to half as age increases, especially within the group of elderly over 70 (Demunter, 2005).

Beyond age, the previous results suggest that there must be explanatory variables of the differing behaviour of the elderly in using the Internet (Gilly et al., 2012). Some works (Meuter, Ostrom, Bitner and Roundtree, 2003; Ryu, Kim and Lee, 2009) have identified psychological variables related to age and the behaviour of the elderly in relation to the Internet such as venturesomeness, self-confidence and technology anxiety, or more related to the context specific to the elderly, such as, for example, perceived physical conditions.

Psychological variables that influence online behaviour

Venturesome people are moved by the wish to try out new and exciting things. They are aware that there is a risk involved in their decisions, but they are more daring. It is a question of an intrinsic motivation of the individual towards stimulation, knowledge and achievement (Clarke 2004). Venturesomeness is part of the internal locus of control (Chantal and Vallerand, 1996): the subjects perceive that the facts of their life are effects and consequences of their decisions in such a way that they enjoy facing challenging experiences.

It is to be expected, therefore, that the people who have this personality dimension will be involved in new and challenging activities, such as those related to technology. For example, in the environment of e-business, Siu and Cheng (2001) consider different characteristics of individuals and found that those who adopt them reflect a greater level of venturesomeness than those who do not adopt them, are more predisposed to risk-taking, as well as being more interested in technological developments. In the context of the elderly, Sudbury and Simcock (2009) carried out a segmentation of 650 British people aged 50 to 79, using behavioural variables. Their results indicated that a venturesome character enables differentiating among the elderly. Hence, the segment called positive pioneers has high levels of venturesomeness, as they like to buy and try out new things out of curiosity, to be the first to do so, to comment about it to their friends and to share information.

Technology anxiety is considered to be an example of the state of anxiety (Chua, Chen and Wong, 1999), a transitory state or condition of variable intensity, which fluctuates over time. It is considered that technology anxiety leads to negative impacts in the individual’s cognitive responses (Guo et al., 2013), such as the use of an Internet application, and can be mainly modified through training and experience with the technology. Technology anxiety is the main determinant at the individual level of the use of a technology (Meuter et al., 2003). Furthermore, another of its consequences is the resistance to change, given that those people with high levels of technology anxiety tend to be more concerned about unexpected technological errors (Durndell and Haag, 2002) and this is why they try to maintain the initial state (Guo et al., 2013).

Self-confidence can be defined as people’s own evaluation of their capacity to carry out an activity (Dabholkar and Bagozzi, 2002), and it reflects the degree to which future users believe that they are sufficiently capable of successfully using a specific technology (Walker and Johnson, 2006). Yagil, Cohen and Beer (2013) point out that self-confidence positively influences the intention of using and use a technology. People who have a high self-confidence tend to focus on the fun and entertainment that using the technologies that they know gives them (Dabholkar and Bagozzi, 2002). The level of self-confidence is influenced by demographic variables, such as age and sex (Loibl, Cho, Diekmann and Batte, 2009).

The perceived physical conditions refer to the perception of people’s own physical difficulties in sight, hearing and motor systems which they face in their daily life. These perceptions can serve as internal controls or conditions which inhibit their intention to use a technology (Chen and Chan, 2011; Hough and Kobylanski, 2009). Ageing is a continuous and complex process (Mathur and Moschis, 2005; Moschis, 1994) which involves changes in the way that people interact and respond to their environment (Ryu et al., 2009). The ageing process causes gradual losses in the sensory and motor systems. The most significant changes regarding the use of computers are related to sight and hearing (Xue et al., 2012) and this involves more difficulties in their use (Phang et al., 2006).

Hedonic and utilitarian motivations

The utilitarian perspective in assigning value in purchasing decisions is considered as a task which people carry out seeking economic benefits (Holbrook and Hirschman, 1982). On the other hand, the hedonic perspective refers to emotional and enjoyment aspects connected to the decision made by the purchaser (Hirschman and Holbrook, 1982) that can be more influenced by aesthetic and emotional characteristics which give the product or service a high intrinsic value.

For Babin, Darden and Griffin (1994), a utilitarian value is based on a mental and rational task where the purchase is more functional. On the contrary, a hedonic value of the purchase makes it more festive and fun, reflects the emotional value and considers it to be a pleasurable experience. Hedonic purchasing means an amusing and adventurous escape for the purchaser.

The digital context in purchasing situations has developed proposals which tend to analyse the hedonic and utilitarian benefits in online purchasing situations or related to the acceptation and use of technologies as communication instruments. As Van der Heijden (2004) points out, when a technology provides utilitarian and hedonic benefits at the same time it will be easier to use, though it is the hedonic value which can have a greater influence on the intention of use and its acceptation. Hedonic motivation in the use of technology also influences innovative people, although when experience increases the attractiveness of the technological innovation it can cease to add hedonic value and become more a utilitarian motivation (Venkatesh, Thong and Xu, 2012). In online social network sites, whose motivation is mainly hedonic, the utilitarian value appears as the user’s experience increases.

The utilitarian value is determined by achieving specific aims through carrying out specific tasks (Kim and Han, 2011). This is why functional motivation acts as a key determinant in the intention of use of a technology.

In the context of e-banking, however, the technical characteristics of the system are considered to be more influential in the intention of use, these being the functional characteristics of the bank’s website (Ndubisi and Sinti, 2006). This is why the efforts to give a better usability to e-banking platforms is concentrated on purely utilitarian aspects, such as convenience, accessibility, and the availability of information in the purchasing website (Martínez-López, Pla-García, Gázquez-Abad and Rodríguez-Ardura, 2014). Even so, some investigations find that hedonic motivation, measured through perceived enjoyment, is important in determining the consumption of technological products and services (Brown and Venkatesh, 2005; Nysveen, Pedersen and Thorbjornsen, 2005; Van der Heijden, 2004).

To sum up, the dual approach about hedonic or utilitarian motivation in the use of technologies and the online behaviour seems to opt differently when the technology is a more utilitarian application and one from which a rational and economic performance is expected, such as e-banking (Ndubisi and Sinti, 2006). On the other hand, the interest in considering hedonic motivations is centred more on virtual contexts related to leisure and entertainment (Suárez-Álvarez, Del Río-Lanza, Vázquez-Casielles and Díaz-Martín, 2008), in which we include the use of online social networks.

Research method

Description of the sample

The sample was collected using students over 55 years old enrolled in a Class of Experience in a University in the South of Europe (Spain). Data were collected through a survey during the months of November and December 2015, during class, using a self-administered survey questionnaire. The initial research questionnaire was developed from well-validated instruments used in previous studies. A pre-test of this questionnaire was carried out with seven students who completed the questionnaire and provided feedback regarding their opinions about the questions. This led to a revision of the questionnaire, which, in its second version was sent to the General Directorate for Quality, Research, Development and Innovation of the Regional Government of Andalusia (Spain), which ruled that it fulfilled the necessary requirements of the suitability of the ethical protocol related with the study’s aims and that is in keeping with the ethical principles applicable to this type of study.

Five hundred and seventy-six questionnaires were obtained after a process of refining and eliminating the questionnaires incorrectly filled out. This led to 474 valid surveys (the response rate was 82.29%). The proportion of women of 65.4%, the mean age was 64 (an age range of 55-85), secondary studies 53.8%, and university studies 35.1%, and the socioeconomic class was mostly middle class: 80%.

Measurement scales

To analyse the use of e-banking we used the scale employed by Kwon and Wen (2010) whose items were anchored on a 7-point Likert scale (1 = strongly disagree; 7 = strongly agree). Regarding social networks, it was asked if respondents used them and if they had an account (no/yes) and which networks they used (Facebook, Twitter or others), and the number of networks that they used was extracted from this (0: none to 4: four networks). A total of nine banking services carried out through the Internet was presented in the questionnaire as well as nine social network tools, requesting that the frequency of use be indicated (1: no use, 2: several times a month, 3: several times a week). Three e-banking services and social network tools were selected which contained a higher average: checking bank accounts, carrying out transfers and obtaining information about my investment portfolio; making comments, showing photographs and chatting in the social network.

The variables that we used to describe the latent classes or co-variables were sex, age, level of studies, as well as four psychological constructs: perceived physical condition, measured by the scale proposed by Ryu et al. (2009) and Phang et al. (2006); venturesomeness, technology anxiety and self-confidence, measured by the scale proposed by Meuter et al. (2003). The items of these four constructs were anchored on a 7-point Likert scale.

To assess the constructs use of e-banking, and the four psychological co-variables, we conducted a confirmatory factor analysis using partial least squares with SmartPLS 2.0.M3. Based on the factor analysis results, we analyse convergent validity, discriminate validity, and the reliability of all the multiple-item scales (Fornell and Larcker, 1981). These factors were then introduced into the cluster model.

Statistical tools

For segmentation purposes, we use a latent class cluster model. First, this model performs post hoc segmentation, as the number and type of segments is determined on the basis of the results of the analysis of the data and also classifies every individual within a single segment (Wilson-Jeanselme and Reynolds, 2006). Secondly, these models describe the relation between the variable observed and enable the inclusion of additional parameters that explain the relationship between the known variables and other latent and unknown variables a priori (Vermunt and Magidson, 2005; Wedel and Kamakura, 2000). Furthermore, different studies have demonstrated their superiority over traditional cluster techniques (DeSarbo and Wedel, 1994; Rondán-Cataluña, Sánchez-Franco and Villarejo-Ramos, 2010), as they identify clusters that group cases or individuals who share interests or characteristics, which are similar and different to those grouped in other clusters and whose responses are generated by the probability distribution (Magidson and Vermunt, 2004). The statistical software used for the latent cluster segmentation was Latent Gold 4.0.

Results

We conducted a confirmatory factor analysis, to assess the constructs (use of e-banking, perceived physical condition, venturesomeness, technology anxiety and self-confidence).

| Constructs | Items | Loadings |

|---|---|---|

| Perceived physical condition AVE: 0.730 Composite reliability: 0.889 Cronbach’s Alpha: 0.820 |

Requires me to exert more effort to perform daily activities. Limits the kind of activities that I can perform.. Causes me to have difficulty in performing daily activities | 0.735 0.896 0.922 |

| Technology anxiety AVE: 0.641 Composite reliability: 0.877 Cronbach’s Alpha: 0.813 |

I have difficulty understanding most technology matters. When given the opportunity to use technology, I fear I might damage it in some way. I have avoided technology because it is unfamiliar to me I hesitate to use technology for fear of making mistakes I cannot correct. |

0.763 0.837 0.790 0.811 |

| Self confidence AVE: 0.598 Composite reliability: 0.817 Cronbach’s Alpha: 0.666 |

I think I have more self-confidence than most people. I am more independent than most people. I often can talk others into doing something. |

0.738 0.809 0.772 |

| Venturesomeness AVE: 0.828 Composite reliability: 0.905 Cronbach’s Alpha: 0.809 |

I like to try new and different things. I enjoy doing new things. |

0.961 0.855 |

| Use of e-banking AVE: 0.848 Composite reliability: 0.943 Cronbach’s Alpha: 0.911 |

I use the Internet banking frequently. I expend a lot of time using Internet banking. I am very involved with the Internet banking. |

0.855 0.918 0.931 |

To determine the number of clusters that best fits the data, we requested the extraction of 1 to 7 clusters. The Bayesian (BIC), Akaike (AIC) and corrected Akaike (CAIC) information criteria (based on the log-likelihood) compare the different solutions of the models, based on the fit and the simplicity (Vermunt and Magidson, 2005). The lowest values of these criteria were attained with the 5-cluster model. Regarding the goodness in classifying the cases in the clusters, the classification errors (better when closer to zero), the standard R2 regression statistic (better when closer to zero), and the approximate weight of evidence, proposed by Banfield and Raftery, 1993) (better when its value is lower) support the decision to select the 5-cluster model (Table 2).

| Cluster | Log-likelihood | Bayesian IC (Log-likelihood) | Npar* | Classification errors | R2 standard | Approximate weight of evidence | ||

|---|---|---|---|---|---|---|---|---|

| 1-Cluster | -3849.5517 | 7816.1664 | 19 | 0 | 1 | 7990.2294 | ||

| 2-Cluster | -3327.0551 | 6900.5584 | 40 | 0.022 | 0.9308 | 7326.1065 | ||

| 3-Cluster | -3145.305 | 6666.4436 | 61 | 0.0424 | 0.9027 | 7330.5352 | ||

| 4-Cluster | -3035.165 | 6575.5489 | 82 | 0.0532 | 0.8889 | 7463.2643 | ||

| 5-Cluster | -2787.5664 | 6209.7372 | 103 | 0.0434 | 0.9159 | 7269.2739 | ||

| 6-Cluster | -2741.6493 | 6247.2883 | 124 | 0.0519 | 0.9014 | 7526.5044 | ||

| * Npar = the number of parameters included in the analysis: this increases as the number of clusters increases. | ||||||||

We use Wald tests to estimate the difference of the means and probabilities between classes. The indicators analysed in the model are all significant (Table 3), as shown in the p-value of the Wald statistic (below 0.05). Therefore, each indicator contributes significantly to the ability to discriminate between clusters. The R2 measure for each indicator, defined as the ratio of variation among classes and the total variation of the analysed variable, displays how much variance of each indicator is explained by the 5-cluster model.

| Indicator | Cluster 1 | Cluster 2 | Cluster 3 | Cluster 4 | Cluster 5 | Wald | p-value | R2 |

|---|---|---|---|---|---|---|---|---|

| E-banking use | 0.919 | -0.938 | 0.593 | -0.029 | -0.545 | 1882.096 | 1.1E-406 | 0.627 |

| E-b checking bank accounts | 1.733 | -1.183 | 1.866 | -1.639 | -0.776 | 109.127 | 1.10E-22 | 0.580 |

| E-b transferring accounts | 2.115 | -0.607 | 2.100 | -2.131 | -1.476 | 64.966 | 2.60E-13 | 0.393 |

| E-b information of portfolio | 1.615 | -0.681 | 1.563 | -2.260 | -0.237 | 55.580 | 2.50E-11 | 0.292 |

| No use of social networks | -1.715 | 1.136 | 0.994 | 0.501 | -0.916 | 95.608 | 8.50E-20 | 0.573 |

| Use of social networks | 1.715 | -1.136 | -0.994 | -0.501 | 0.916 | 95.608 | 8.50E-20 | 0.573 |

| No social network account | -1.693 | 0.875 | 0.948 | 1.018 | -1.147 | 116.619 | 2.80E-24 | 0.682 |

| Has social network account | 1.693 | -0.875 | -0.948 | -1.018 | 1.147 | 116.619 | 2.80E-24 | 0.682 |

| No. of social networks | 1.781 | -1.246 | -1.211 | -0.715 | 1.391 | 51.973 | 1.40E-10 | 0.412 |

| Making comments | 2.941 | -2.054 | 0.451 | -4.547 | 3.209 | 64.941 | 2.60E-13 | 0.515 |

| Showing photographs | 1.216 | -0.588 | 0.151 | -2.607 | 1.829 | 69.544 | 2.80E-14 | 0.283 |

| Chatting in the network | 3.024 | -3.950 | 0.907 | -3.349 | 3.369 | 30.130 | 4.60E-06 | 0.311 |

Socio-demographic and psychographic characteristics of individuals affect the latent variable but have no direct effect on the indicators. These covariates enable the identification of members of each cluster. Sex, age, venturesomeness and technology anxiety are significant in the model of five clusters, as shown in the p-value of the Wald statistic (below 0.5) (Table 4).

| Covariates | Cluster 1 | Cluster 2 | Cluster 3 | Cluster 4 | Cluster 5 | Wald | p-value |

|---|---|---|---|---|---|---|---|

| Sex* Men Women | 0.359 -0.359 | -0.240 0.240 | 0.465 -0.465 | -0.447 0.447 | -0.137 0.137 | 31.544 | 2.40E-06 |

| Age | -0.041 | 0.020 | -0.026 | 0.077 | -0.030 | 12.321 | 0.015 |

| Educational level* | 0.168 | -0.097 | 0.084 | 0.316 | -0.470 | 4.725 | 0.320 |

| Venturesomeness | 0.351 | -0.247 | 0.160 | -0.316 | 0.050 | 18.230 | 0.0011 |

| Perceived physical condition | 0.018 | 0.069 | 0.162 | -0.255 | 0.005 | 4.487 | 0.34 |

| Self-confidence | 0.027 | -0.174 | -0.041 | -0.002 | 0.188 | 3.681 | 0.45 |

| Technology anxiety | -0.212 | 0.316 | -0.093 | -0.160 | 0.152 | 13.781 | 0.008 |

| * Nominal variables | |||||||

In Table 5 we present the size of the five clusters. The profiles indicate the conditional probabilities of each dichotomous indicator. In the case of continuous indicators the averages are indicated and in the case of ordinal indicators the probabilities and means are presented.

| Indicators | Cluster 1 | Cluster 2 | Cluster 3 | Cluster 4 | Cluster 5 |

|---|---|---|---|---|---|

| Cluster size | |||||

| 0.260 | 0.252 | 0.179 | 0.171 | 0.136 | |

| E-banking use (mean) | 0.888 | -0.967 | 0.563 | -0.059 | -0.574 |

| Check the balance of my accounts (mean) - no use - several times a month - several times a week |

1.477 0.079 0.363 0.556 |

0.227 0.788 0.194 0.016 |

1.529 0.065 0.341 0.594 |

0.148 0.858 0.134 0.007 |

0.327 0.705 0.262 0.032 |

| Transfer funds between accounts (mean) - no use -several times a month -several times a week |

0.879 0.323 0.476 0.201 |

0.093 0.909 0.088 0.002 |

0.871 0.327 0.475 0.198 |

0.021 0.979 0.021 0.000 |

0.040 0.960 0.039 0.001 |

| Information on my investment portfolio (mean) - no use -several times a month -several times a week |

0.827 0.435 0.302 0.263 |

0.076 0.929 0.065 0.006 |

0.793 0.454 0.299 0.247 |

0.015 0.986 0.014 0.000 |

0.124 0.890 0.097 0.013 |

| No social network use | 0.024 | 0.880 | 0.847 | 0.674 | 0.108 |

| Use of social networks | 0.976 | 0.120 | 0.153 | 0.326 | 0.892 |

| No social network account | 0.092 | 0.945 | 0.952 | 0.958 | 0.231 |

| Has social network account | 0.908 | 0.055 | 0.048 | 0.042 | 0.769 |

| Number of social networks (mean) | 1.493 | 0.336 | 0.345 | 0.480 | 1.279 |

| making comments (mean) -no use -several times a month -several times a week |

1.002 0.252 0.494 0.254 |

0.013 0.987 0.013 0.000 |

0.151 0.855 0.139 0.006 |

0.001 0.999 0.001 0.000 |

1.137 0.189 0.485 0.326 |

| showing photographs (mean) - no use - several times a month - several times a week |

0.647 0.515 0.323 0.162 |

0.108 0.899 0.093 0.008 |

0.232 0.798 0.173 0.030 |

0.014 0.986 0.014 0.000 |

1.022 0.310 0.358 0.332 |

| chatting in the network (mean) - no use - several times a month - several times a week |

0.609 0.541 0.309 0.150 |

0.001 1.000 0.001 0.000 |

0.072 0.932 0.064 0.004 |

0.001 0.999 0.001 0.000 |

0.811 0.424 0.342 0.234 |

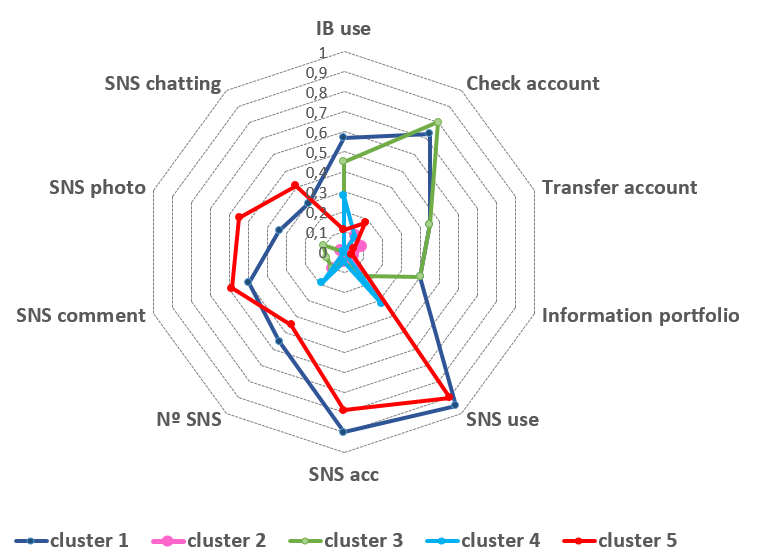

The values of the profiles of the indicators for the clusters are shown in Figure 1.

Figure 1: Cluster profiles (IB = Internet banking; SNS = social networks)

The values are re-scaled to always lie within the 0-1 range, and for dichotomous variables specified as nominal (no/yes) by default only the last category is displayed. The values of significant covariates for clusters are also presented (Table 6).

| Covariates | Cluster 1 | Cluster 2 | Cluster 3 | Cluster 4 | Cluster 5 |

|---|---|---|---|---|---|

| Sex* Men Women |

0.496 0.504 | 0.206 0.792 | 0.540 0.459 | 0.201 0.799 | 0.225 0.773 |

| Age | 63.164 | 64.238 | 63.809 | 65.049 | 63.194 |

| Educational level Primary Secondary University |

0.037 0.544 0.354 |

0.155 0.491 0.269 |

0.092 0.461 0.377 |

0.121 0.428 0.306 |

0.113 0.513 0.297 |

| Venturesomeness | 0.237 | -0.192 | 0.098 | -0.255 | 0.094 |

| Perceived physical condition | -0.066 | 0.073 | 0.076 | -0.140 | 0.068 |

| Self-confidence | 0.031 | -0.099 | -0.001 | -0.043 | 0.179 |

| Technology anxiety | -0.254 | 0.307 | -0.120 | -0.090 | 0.189 |

Next we analyse the information on the profiles of the indicators and the covariates together in order to identify, describe and suggest a denomination for each cluster.

CLUSTER 1: made up of 26% of the respondents. This is the segment which most uses e-banking and uses the three services analysed, especially to check the balance of the accounts, with a frequency of several times a week. It is the group which most uses social networks - they are present in more than one and 90% of the individuals have an account. The most common activity in such networks is carrying out comments, several times a month. With regard to the covariates, there are no differences between the number of men and women (49.6 – 50.4%, respectively), their mean age is the lowest of the five clusters, they are the individuals who have the greatest venturesomeness and have less technology anxiety. We denominate this cluster e-elderly

CLUSTER 2: is made up 25.2% of the sample. These people do not use e-banking or social networks. About 79% are women. The motives of non-use stem from the fact that they are individuals who are not interested in trying out new things, as well as being the segment with greater technology anxiety. We call this group fearful of technology.

CLUSTER 3: almost 18% of the sample. They use e-banking, and have high values in the measures of use for the three services analysed, but 85% of this group do not use social networks. The percentage of men is 54%. They feel slightly adventurous and are not afraid of facing technology. Although the level of studies is not a significant covariate when differentiating between classes, it is worth highlighting that this group is the one with a greater percentage of university studies. Given that these individuals show an online behaviour defined by utilitarian applications (e-banking), we name it e-users for convenience.

CLUSTER 4: is made up 17% of the sample. They do not use e-banking. Almost a third of this group have used social networks, though they have the lowest percentage of network accounts. Almost 80% are women and they have the highest mean age. It is the least venturesome segment and yet they are not afraid of technologies. A possible explanation of this segment is that the individuals have used social networks through family members. This would explain why they do not have an account and do not have to face the challenge of using technologies, as others do it for them. We call this group surfing with the family.

CLUSTER 5: 13.6% of the sample. They do not use e-banking, but they do use social networks (89.2%). They have a high percentage of taking them into account (76.9%), are in more than one online social network and have the largest mean of use of the social network tools analysed. 77.3% are women, with a very low average age, are slightly venturesome, are not afraid of technology and this is the segment with most self-confidence. These individuals show an online behaviour that has a hedonic leaning. We call it hooked by networks.

Discussion

The aim of our work was to discover the existence of heterogeneity in the behaviour of the elderly regarding services available in Internet. The results support the idea proposed. The stereotype of the elderly cut off from technology is mistaken, as is shown by the different segments found. Next, we will discuss the classes found more thoroughly.

The largest group is what we call e-elderly. This segment has crossed the digital gap and actively uses the Internet services we have analysed. Other authors have obtained similar results with regard to this group of individuals, calling them silver tsunami (Fox, 2004), new age (Mathur, Sherman and Schiffman, 1998) or baby boomers (Niemelä-Nyrhhinen, 2007). They are the elderly who most enjoy new experiences and interacting with technology does not produce anxiety in them. This segment will show a greater propensity to using new tools and online applications, with which they will seek hedonic benefits linked to activities of leisure and free time and utilitarian benefits with applications which facilitate their routine activities. They will therefore be an attractive segment for firms of online tourist services, mobile applications concerning leisure and culture, financial services, e-administration and health applications, among others.

Another of the segments identified is that of e-users for convenience. This group uses e-banking, but does not use online social networks. The largest percentage of men is to be found in this segment. In this sense, Venkatesh and Morris (2000) find that the main motivation for men for using technology is the usefulness which they perceive. Equally, it has been found that men are most involved in complicated online activities, such as e-banking (Fallows, 2005; Nayak, Priest and White, 2010). Furthermore, this segment is characterised by being the one that has the worst perception of their physical conditions: therefore, facilitating their daily activities would be a determinant motive for using e-banking (Chen and Chan, 2014; Mitzner et al., 2010). This segment, as with that of the e-elderly, can be the aim of e-administration applications and online services of frequent activities in general, given its marked utilitarian character.

The cluster denominated hooked by networks shows the opposite behaviour to the previous segment: they use social network sites but not e-banking. Their level of involvement with networks is high: they are present in more than one network and have a high frequency of use of the tools analysed. It is a largely female segment, who were more likely to employ social media than men (Pálsdóttir, 2014). In this sense there is a connection between women and social networks, irrespective of age, as the results of Comscore (2011), Observatorio Nacional de las Telecomunicaciones y de la Sociedad de la Información (2011) and Porter Novelli (2012) show for Spain. Thus, with respect to men, the percentage of women with social network accounts is higher, they access more frequently, spend more time using the sites and carry out different activities (Joiner et al., 2012; Pedersen and Macafee, 2007). The use of online social networks is more due to hedonic motives than to utilitarian ones (Li, 2011), and the determinants of their use are intrinsic motivations (Sledgianowski and Kulviwat, 2009) and social influences (Jackson et al. 2001, Schumacher and Morahan-Martin, 2001). This segment may be especially interesting for firms active in fashion, leisure, culture, tourism, personal care, etc., as the elderly included in it may be generators of positive attitudes towards these products through online recommendations (e-word-of-mouth) and through comments and contents shared in online social networks.

In the group called surfing with the family we find the elderly who use online social networks, although, surprisingly, they do not have any account in them. This segment is characterised by a greater presence of women and it is the one with the highest mean age. Moreover, they do not feel technology anxiety, clearly because they do not use it directly but have the support of the family to use it. The lack of interest in surfing themselves is probably the result of not needing to use the technologies in their daily life, or not experiencing social pressure to do so (Iyer and Eastman, 2006; Nayak et al., 2006; Reisenwitz et al., 2007). We consider that this segment is possibly that which is most cut off from new technologies – they understand the usefulness and the enjoyment of Internet and its applications but someone is responsible for facilitating them with access to it and this reduces their intention to use.

Finally, the cluster fearful of technology is the fourth part of the sample. It is made up of those people who use neither e-banking nor online social networks, probably because they use Internet little or not at all. They possibly prefer to use traditional means to obtain the information and the services they need (Morrell et al., 2005). Almost 80% of this segment is made up of women. From a psychological profile, we register that they are individuals who are not very venturesome, they are not interested in trying out new things and they have technology anxiety. In this vein, Hough and Kobilansky (2009), Nayak et al. (2010) and Wood et al. (2010) also find that elderly women express more negative attitudes, higher levels of anxiety, greater risk aversion, a lower level of self-perceived skills (Van Deursen and Van Dijk, 2010) and less confidence in the use of computers and the Internet. Nonetheless, all these circumstances can be overcome through training and learning and, with this in mind, different public and private institutions strive for the education of the elderly in new technologies and the overcoming of the digital gap.

Implications and conclusions

Older consumers are a heterogeneous group, due to diversity in needs, lifestyles and consumption habits (Sudbury and Simcock, 2009). For the analysed applications of Internet we check as still exist different segments of elderly, depending on its use. Since each one has different intrinsic motivations, and each segment has a own latent behaviour, different implications should be taken.

The following segments are especially important as management implications for firms with an online presence: 1) e-elderly, disposed to both using applications which facilitate their daily activities and to enjoying online experiences related to the fact of sharing and enjoying their virtual environment; 2) e-users for convenience, who are mainly motivated by the utilitarian value, will more greatly value platforms and applications that are well-designed and usable from the perspective of the online consumer; and 3) hooked by networks, a segment of users very given to responding to promotional stimuli through campaigns in online social networks, as well as their use as prescribers and influencers in the behaviour of others through the e-word-of-mouth effect.

However, the effort of online companies to engage older people further away from the Internet can be high. They would have to convince them of the need for their use. Having the support of family and friends in their first approaches may allow them to rely on their abilities to use the Internet and its applications.

All this without forgetting a series of recommendations that although are general for the population of any age, but that in the case of the majors are essential: 1) develop systems offering security and privacy to customers, because the first step is increase trust in online payment systems; 2) design of information campaigns, emphasizing the security of the Internet channel; 3) increase customers' knowledge of online matters developing promotion activities in comprehensible language; 4) clarify for customers the advantages and ease of using the Internet services; and 4) design Web sites that are especially easy to use, and more friendly for elder people.

Regarding the limitations of this research, we point out that given the difficulty of collecting data from elders, we use a convenience sample made up of students enrolled in the Classroom of Experience. To broaden the sample to other contexts would increase the heterogeneity of the people, which would strengthen the conclusions proposed. Secondly, the method used implies that if there is a consideration of other variables the results may vary. In our case, we have chosen the services of e-banking and online social networks, because we consider that each is an extreme of the continuum which brings together the utilitarian component versus the hedonic component, as we seek to obtain the maximum heterogeneity in the behaviour. The use of other electronic services, such as the purchasing of tourist products, in which economic and emotional aspects coexist, could lead to different segments.

To conclude, the aim of the present work was to show the existence of heterogeneity in the online behaviour of the elderly from the previous bibliographic review concerning the elderly and information and communication technologies. This aim is upheld by the literature which confirms the existence of different segments of the elderly regarding the use of Internet and their online behaviour in general. The novelty of this study is its analysis of these differences in the online behaviour of the elderly from two different online applications: one utilitarian, e-banking; the other hedonic, online social networks. We have extracted five segments with strongly differentiated profiles in the use that they give to these applications and regarding the psychological variables analysed, which are usually employed in studies on the behaviour of elderly people as consumers in general and as users of new technologies. The definition and characteristics of the segments found in this study are similar to those found in different investigations on the elderly in English-speaking countries. Finally, we highlight in this work the use of a latent classes cluster model, whose capacity for segmenting and describing the classes obtained surpasses other traditional segmentation techniques.

About the authors

Ángel F. Villarejo-Ramos (corresponding author) is PhD. in Administration and Business Management. Associate Professor in Marketing at the University of Seville (Spain). His research interests include acceptance and use of Information Systems, customer equity management, brand equity, ecommerce and social network sites. He is currently head of the Analytic and Digital Marketing Research Group, and academic director of Social Media Marketing Program at University of Seville. He can be contacted at: curro@us.es.

Begoña Peral-Peral, Ph.D. in Business Administration (2007). Currently, she is Associate Professor in the Department of Business Administration and Marketing at the University of Seville (Spain). Her research interests include the acceptance of new technologies, e-commerce, elderly and consumer behaviour. She can be contacted at: bperal@us.es.

Jorge Arenas-Gaitán, Ph.D. in Business Administration (2003) and, currently, Associate Professor in the Department of Business Administration and Marketing at the University of Seville (Spain). His research interests include the acceptance of new technologies, e-commerce, elderly, market segmentation and cross-cultural analysis. He can be contacted at: jarenas@us.es.

References

- Agudo Prado, S., Pascual Sevillano, M.A. & Fombona Cadavieco, J. (2012). Usos de las herramientas digitales entre las personas mayores. [Uses of digital tools among the elderly]. Comunicar, 20(39), 193-201. Retrieved from https://dialnet.unirioja.es/descarga/articulo/4014458/2.pdf (Archived by the Internet Archive at https://bit.ly/2Oa16bv)

- Babin, B.J., Darden, W.R. & Griffin, M. (1994). Work and/or fun: measuring hedonic and utilitarian shopping value. Journal of Consumer Research, 20(4), 644-656.

- Banfield, J.D. & Raftery, A.E. (1993). Model-based Gaussian and non-Gaussian clustering. Biometrics, 49(3), 803-821.

- Brown, S. A. & Venkatesh, V. (2005). Model of adoption of technology in the household: a baseline model test and extension incorporating household life cycle. MIS Quarterly, 29(4), 399-426.

- Chantal, Y. & Vallerand, R.J. (1996). Skill versus luck: a motivational analysis of gambling involvement. Journal of Gambling Studies, 12(4), 407-418.

- Chen, K. & Chan, A. H. S. (2011). A review of technology acceptance by older adults. Gerontechnology, 10(1), 1-12.

- Chen, K. & Chan, A. H. (2014). Predictors of gerontechnology acceptance by older Hong Kong Chinese. Technovation, 34(2), 126-135.

- Chua, S. L., Chen, D.-T. & Wong, A. F. (1999). Computer anxiety and its correlates: a meta-analysis. Computers in Human Behavior, 15(5), 609-623.

- Chung, J., Park, N., Wang, H, Fulk, J. & McLaughlin, M. (2010). Age differences in perceptions of online community participation among non-users: an extension of the technology acceptance model. Computers in Human Behaviour, 26(6), 1674-1684.

- Clarke, D. (2004). Impulsiveness, locus of control, motivation and problem gambling. Journal of Gambling Studies, 20(4), 319-345.

- COMSCORE (2011). Comscore releases overview of European Internet usage for May 2011. Reston, VA: Comscore. Retrieved from https://www.comscore.com/Insights/Press-Releases/2011/7/comScore-Releases-Overview-of-European-Internet-Usage-for-May-2011 (Archived by the Internet Archive at https://bit.ly/2qfVB30)

- Cresci, M.K., Yarandi, H.N. & Morrell, R.W. (2010). Pro-nets versus no-nets: differences in urban older adults’ predilections for internet use. Educational Gerontology, 36(6), 500-520.

- Czaja, S. J. & Sharit, J. (1998). Age differences in attitudes toward computers. The Journals of Gerontology Series B: Psychological Sciences and Social Sciences, 53(5), 329-340.

- Dabholkar, P.A. & Bagozzi, R.P. (2002). An attitudinal model of technology-based self-service: moderating effects of consumer traits and situational factors. Journal of the Academy Marketing Science, 30(3), 184-201.

- Demunter, C. (2005). The digital divide in Europe. Statistics in Focus, No. 38. Retrieved from https://ec.europa.eu/eurostat/documents/3433488/5572700/KS-NP-05-038-EN.PDF/15d4a86b-929e-4757-bcf5-ad0e1502a387 (Archived by the Internet Archive at https://bit.ly/34T7Q4q)

- Dennis, C., Merrilees, B., Jayawardhena, C. & Wright, L.T. (2009). E-consumer behaviour. European Journal of Marketing, 43(9/10), 1121-1139.

- DeSarbo, W.S. & Wedel, M. (1994). A review of recent developments in latent class regression models. In R.P. Bagozzi (Ed.), Advanced methods of marketing research (pp. 352-388). Cambridge, MA: Basil Blackwell.

- Durndell, A. & Haag, Z. (2002). Computer self-efficacy, computer anxiety, attitudes towards the Internet and reported experience with the Internet, by gender, in an East European sample. Computers in Human Behavior, 18(5), 521-535.

- Dyck, J. L. & Smither, J. A.-A. (1994). Age differences in computer anxiety: the role of computer experience, gender and education. Journal of Educational Computing Research, 10(3), 238-248.

- Fallows, D. (2005). How women and men use the Internet. Washington, DC: Pew Research Inc. Retrieved from https://www.pewinternet.org/2005/12/28/how-women-and-men-use-the-internet/ (Archived by the Internet Archive at https://bit.ly/2NN0Bp5)

- Fornell, C., & Larcker, D. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

- Fox, S. (2004). Older Americans and the Internet. Washington, DC: Pew Research Inc. Retrieved from https://www.pewinternet.org/2004/03/28/older-americans-and-the-internet/ (Archived by the Internet Archive at https://bit.ly/2rBOxy2)

- Gilly, M. C., Celsi, M. W. & Schau, H. J. (2012). It don't come easy: overcoming obstacles to technology use within a resistant consumer group. Journal of Consumer Affairs, 46(1), 62-89.

- Guo, X., Sun, Y., Wang, N., Peng, Z. & Yan, Z. (2013). The dark side of elderly acceptance of preventive mobile health services in China. Electronic Markets, 23(1), 49-61.

- Hill, R., Beynon-Davies, P. & Williams, M. (2008). Older people and Internet engagement. Acknowledging social moderators of Internet adoption, access and use. Information Technology & People, 21(3), 244-266.

- Hirschman, E.C. & Holbrook, M.B. (1982). Hedonic consumption: emerging concepts, methods and propositions. Journal of Marketing, 46(3), 92-101.

- Hogeboom, D. L., McDermott, R.J., Perrin, K.M., Osman, H. & Bell-Ellison, B.A. (2010). Internet use and social networking among middle aged and older adults. Educational Gerontology, 36(2), 93-111.

- Holbrook, M.B. & Hirschman, E.C. (1982). The experiential aspects of consumption: consumer fantasies, feelings, and fun. Journal of Consumer Research, 9(2), 132-140.

- Hough, M. & Kobylanski, A. (2009). Increasing elder consumer interactions with information technology. Journal of Consumer Marketing, 26(1), 39-48.

- Iyer, R. & Eastman, J. (2006). The elderly and their attitudes toward the Internet: the impact on Internet use, purchase and comparison shopping. Journal of Marketing Theory and Practice, 14(1), 57-67.

- Jackson, L. A., Ervin, K. S., Gardner, P. D. & Schmitt, N. (2001): Gender and the Internet: women communicating and men searching. Sex Roles: A Journal of Research, 44(5), 363.

- Joiner, R., Gavin, J., Brosnan, M., Cromby, J., Gregory, H., Giller, J., Maras, P. & Moon, A. (2012). Gender, internet experience, internet identification, and internet anxiety: a ten-year followup. Cyberpsychology, Behavior, and Social Networking, 15(7), 370-372.

- Jolie C.Y. L. & Mattthew K.O. L. (2006). Digital inclusiveness—longitudinal study of internet adoption by older adults. Journal of Management Information Systems 22(4), 177–206.

- Jones, S. & Fox, S. (2009). Generations online in 2009. Washington, DC: Pew Research Center. Retrieved from https://www.pewinternet.org/2009/01/28/generations-online-in-2009/ (Archived by the Internet Archive at https://bit.ly/35203kU)

- Kim, B. & Han, I. (2011). The role of utilitarian and hedonic values and their antecedents in a mobile data service environment. Expert Systems with Applications, 38(3), 2311-2318.

- Kurniawan, S. (2008). Older people and mobile phones: a multi-method investigation. International Journal of Human-Computer Studies, 66(12), 889-901.

- Kwon, O. & Wen, Y. (2010). An empirical study of the factors affecting social network service use. Computers in Human Behavior, 26(2), 254-263.

- Lam, J. C. & Lee, M. K. (2006). Digital inclusiveness—longitudinal study of Internet adoption by older adults. Journal of Management Information Systems, 22(4), 177-206.

- Li, D.C. (2011). Online social network acceptance: a social perspective. Internet Research, 21(5), 562-580.

- Loibl, C., Cho, S. H., Diekmann, F. & Batte, M. T. (2009). Consumer self‐confidence in searching for information. Journal of Consumer Affairs, 43(1), 26-55.

- Magidson J. & Vermunt J.K. (2004). Latent class models. In D. Kaplan (Ed.). The Sage handbook of quantitative methodology for the social sciences (pp. 175-198). Thousand Oaks, CA: Sage Publications.

- Martínez-López, F., Pla-García, C., Gázquez-Abad, J.C. & Rodríguez-Ardura, I. (2014). Utilitarian motivations in online consumption: Dimensional structure and scales. Electronic Commerce Research and Applications, 13(3), 188-204.

- Mathur, A. & Moschis, G.P. (2005). Antecedents of cognitive age: a replication and extension. Psychology & Marketing, 22(12), 969-994.

- Mathur, A., Sherman, E. & Schiffman, L.G. (1998). Opportunities for marketing travel services to new‐age elderly. Journal of Services Marketing, 12(4), 265-277.

- McCloskey, D. (2006). The importance of ease of use, usefulness, and trust to online consumers: an examination of the technology acceptance model with older consumers. Journal of Organizational and End User Computing, 18(3), 47-65.

- Meuter, M.L., Ostrom, A.L., Bitner, M.J. & Roundtree, R. (2003). The influence of technology anxiety on consumer use and experiences with self-service technologies. Journal of Business Research, 56(11), 899-906.

- Mitzner, T. L., Boron, J. B., Fausset, C. B., Adams, A. E., Charness, N., Czaja, S. J., . . . Sharit, J. (2010). Older adults talk technology: technology usage and attitudes. Computers in Human Behavior, 26(6), 1710-1721.

- Morrell, R. W., Dailey, S. R., Stoltz-Loike, M., Mayhorn, C. B. & Echt, K. V.(2005). Information technology and older adults. The evolution of scientific research and Website accessibility guidelines. Bethesda, MD: National Institute on Aging.

- Moschis, G. P. (1994). Consumer behavior in later life: Multidisciplinary contributions and implications for research. Academy of Marketing Science. Journal, 22(3), 195-204.

- Nayak, L., Priest, L., Stuart-Hamilton, I. & White, A. (2006). Website design attributes for retrieving health information by older adults: an application of architectural criteria. Universal Access in the Information Society, 5(2), 170-179.

- Nayak, L.U.S., Priest, L. & White, A.P. (2010). An application of the technology acceptance model to the level of Internet usage by older adults. Universal Access in the Information Society, 9(4), 367-374.

- Ndubisi, N.O. & Sinti, Q. (2006). Consumer attitudes, system’s characteristics and Internet banking adoption in Malaysia. Management Research News, 29(1/2), 16-27.

- Niemelä-Nyrhinen, J. (2007). Baby boom consumers and technology: shooting down stereotypes. Journal of Consumer Marketing, 24(5), 305-312.

- Nysveen, H., Pedersen, P. E. & Thorbjornsen, H. (2005). Intentions to use mobile services: antecedents and cross-service comparisons. Academy of Marketing Science Journal, 33(3), 330-346.

- Observatorio Nacional de las Telecomunicaciones y de la Sociedad de la Información. (2011). Estudio sobre el conocimiento y uso de las Redes Sociales en España. [Study on the knowledge and use of social networks in Spain]. Madrid: ONTSI. Retrieved from https://www.ontsi.red.es/ontsi/es/estudios-e-informes/estudio-sobre-el-conocimiento-y-uso-de-las-redes-sociales-en-espana (Archived by the Internet Archive at https://bit.ly/356Wyd3)

- Pálsdóttir, A. (2014). Preferences in the use of social media for seeking and communicating health and lifestyle information. Information Research, 19(4) paper 642. Retrieved from http://informationr.net/ir/19-4/paper642.html (Archived by WebCite® at http://www.webcitation.org/6UUsfeVem)

- Pedersen S. & Macafee, S. (2007). Gender differences in British blogging. Journal of Computer-Mediated Communications, 12(4), 1472-1492.

- Peral-Peral, B., Arenas-Gaitán, J. & Ramón-Jerónimo, M. (2013). The role of socio-demographic variables in the use of internet-based applications by older people. Innovar, 23(48), 55-66.

- Phang, W. C., Sutanto, J., Kankanhalli, A., Li, Y., Tan, B. C. Y. & Teo, H. H. (2006). Senior citizens’ acceptance of information systems: a study in the context of e-Government services. IEEE Transactions of Engineering Management, 53(4), 555–569.

- Porter Novelli (2012). Los nuevos consumidores sociales en Europa. [The new social consumers in Europe]. [Powerpoint presentation]. Madrid: Porter Novelli. Retrieved from http://goo.gl/Q5WlEr (Archived by the Internet Archive at https://bit.ly/2QlT3uX)

- Reisemwitz, T., Iyer, R., Kuhlmeier, D. & Eastman, J. (2007). The elderly’s Internet usage: an updated look. Journal of Consumer Marketing, 24(7), 406-418.

- Rondan-Cataluña, F.J., Sanchez-Franco, M. J. & Villarejo-Ramos, A.F. (2010). Searching for latent class segments in technological services. The Service Industries Journal, 30(6), 831-849.

- Ryu, M., Kim, S. & Lee, E. (2009). Understanding the factors affecting online elderly user’s participation in video UCC Services. Computers in Human Behavior, 25(3), 619–632.

- Schumacher, P. & Morahan-Martin, J. (2001): Gender, internet and computer attitudes and experiences. Computers in Human Behavior, 17(1), 95-110.

- Siu, N. Y-M. & Cheng, M. M-S. (2001). A study of the expected adoption of online shopping -the case of Hong Kong. Journal of International Consumer Marketing, 13(3), 87-106.

- Sledgianowski, D. & Kulviwat, S. (2009). Using social network sites: the effects of playfulness, critical mass and trust in a hedonic context. Journal of Computer Information Systems, 49(4), 74-83.

- Suárez-Álvarez, L., Del Río-Lanza, A.B., Vázquez-Casielles, R. & Díaz-Martín, A.M. (2008). La calidad utilitaria y hedónica en la distribución turística virtual: influencia sobre la satisfacción y la lealtad [Utilitarian and hedonic quality in virtual tourist distribution: influence on satisfaction and loyalty]. In Julio Pindado Garcia and Gregory Payne (Eds.) Estableciendo puentes en una economía global (pp. 48-64). Madrid: ESIC.

- Sudbury, L. & Simcock, P. (2009). A multivariate segmentation model of senior consumers. Journal of Consumer Marketing, 26(4), 251-262.

- Van der Heijden, H. (2004). User acceptance of hedonic information systems. MIS Quarterly, 28(4), 695-704.

- Van Deursen, A. & Van Dijk, J. (2010). Measuring Internet skills. International Journal of Human-Computer Interaction. 26(10), 891-916.

- Venkatesh, V, Thong, J.Y.L. & Xu, X. (2012). Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157-178.

- Venkatesh, V. & Morris, M. G. (2000).Why don't men ever stop to ask for directions? Gender, social influence, and their role in technology acceptance and usage behaviour. MIS Quarterly, 24(1), 115-139.

- Vermunt, J.K. & Magidson J. (2005). Technical Guide for Latent GOLD 4.0: Basic and advanced. Belmont, MA: Statistical Innovations Inc.

- Walker, R.H. & Johnson L.W. (2006). Why consumers use and do not use technology-enabled services. Journal of Services Marketing, 20(2), 125-135.

- Wedel, M. & Kamakura, W.A. (2000). Market segmentation: conceptual and methodological foundations. Norwell, MA: Kluwer Academic Publishers.

- White, H., McConnell, E., Clipp, E., Bynum, L., Teague, C., Navas, L., Craven, S. & Halbrecht, H. (1999). Surfing the net in later life: a review of the literature and pilot study of computer use and quality of life. Journal of Applied Gerontology, 18(3), 358-378.

- World Economic Forum (2011). Global population ageing: peril or promise? Geneva, Switzerland: World Economic Forum. Retrieved from http://goo.gl/f65RVZ (Archived by the Internet Archive at https://bit.ly/2CGcaI8)

- World Health Organization. (2002). Active ageing: a policy framework. Retrieved from https://www.who.int/ageing/publications/active_ageing/en/ (Archived by the Internet Archive at https://bit.ly/2KjHuk6)

- Wilson-Jeanselme, M. & Reynolds, J. (2006). The advantages of preference-based segmentation. An investigation of online grocery retailing. Journal of Targeting, Measurement and Analysis for Marketing, 14(4), 297-308.

- Wood, E., Lanuza, C., Baciu, I., MacKenzie, M. & Nosko, A. (2010). Instructional styles, attitudes and experiences of seniors. computer workshops. Educational Gerontology, 36(10-11), 834-857.

- Xue, L., Yen, C. C., Chang, L., Chan, H. C., Tai, B. C., Tan, S. B. & Choolani, M. (2012). An exploratory study of ageing women's perception on access to health informatics via a mobile phone-based intervention. International Journal of Medical Informatics, 81(9), 637-648.

- Yagil, D., Cohen, M. & Beer, J.D. (2013) Older adults’ coping with the stress involved in the use of everyday technologies. Journal of Applied Gerontology, 35(2), 131-149.

How to cite this paper

Appendices

Questionnaire used in the study