Exploring the circulation of digital audiobooks: Australian library lending 2006–2017

Millicent Weber, Rebecca Giblin, Yanfang Ding, and François Petitjean-Hèche.

Introduction. We investigated patterns in digital audiobook and e-book circulation through Australian libraries to identify and analyse trends in audiobook publishing and reading.

Method. In partnership with four Australian library services we collated a dataset of 555,618 audiobook checkouts and 3,475,188 e-book checkouts, representing all OverDrive checkouts through these services from 2006 until July 2017.

Analysis. We examined the availability and popularity of audiobook and e-book titles over time. We used bibliographic metadata and manual and automated coding to examine major publishers, sex and nationality of authors, and popular titles and genres.

Results. Audiobooks and e-books have experienced substantial growth since 2006. Major publishers including the Big Five, Amazon, and Bolinda have historically been less important in audiobook publishing than in print or e-book markets, with numerous specialist audio publishers and producers prominent in the field. Audiobooks and e-books show disparities in the sex of authors. Crime, science fiction, and fantasy are the most popular audiobook genres.

Conclusion. Library checkout data confirm audiobook publishing’s recent volatility. Libraries are the keepers of valuable information about new media forms like audiobooks, and collaboration between libraries, publishers, and researchers directly supports understanding of this important new space of cultural production and consumption.

DOI: https://doi.org/10.47989/irpaper899

Introduction

Over the last decade, audiobooks have been the fastest-growing sector in book publishing. For some genres, audiobook revenue has become just as important as hardcover. The audiobook has been transformed from a niche, unwieldy format (HarperCollins’'s The Lord of the Rings, in 2002, ran across forty-six CDs) to the preferred option for growing legions of people who want to experience books while driving, running, doing housework and other non-traditional reading situations. This is reflected in stunning growth: Deloitte estimates the global audiobook market will reach $3.5 billion in 2020, up 25% from 2019 (Stewart et al., 2019). Consequently, ‘According to practically every metric of the publishing industry, audiobooks are winning the format wars’ (English, 2020, p. 419).

Despite their growing market significance, audiobooks are proving difficult to study. Sales data—a key metric by which publishing studies researchers quantify circulation—are difficult to obtain. The market leader, Amazon-owned Audible, refuses to provide that information on any terms (for audiobooks or ebooks). Consequently, international book sales trackers like Nielsen Bookscan rely on mechanisms like surveys to measure audiobooks’ popularity (Wood, 2018a). Where researchers have obtained access to datasets through direct collaboration with publishers, the data have tended to be incomplete (Wallin and Nolin, 2020, p. 476).

OverDrive, the world’s leading e-lending aggregator, has provided a yearly snapshot of library audiobook loans since 2013. This demonstrates tremendous growth (from 22.9 million global audiobook loans in 2013 to 114 million in 2019; OverDrive, 2014, 2020) but says nothing about which books, authors and publishers are borrowed. Such data are only available from libraries themselves, but is notoriously difficult to access. Libraries are reluctant to divulge download figures due to confidentiality restrictions in their agreements with aggregators and publishers and concerns around patron privacy (Giblin et al., 2019a). But thanks to a partnership with library services in the Australian Capital Territory (the ACT), South Australia, Tasmania, and Western Australia, as part of a long-term related research project on e-books, we were able to obtain access to a dataset of over four million audiobook and e-book checkouts, incorporating bibliographic data for every single checkout across those jurisdictions since they adopted OverDrive. We use this to understand the growth trajectory of audiobooks’ availability and popularity, and the kinds of authors, publishers, and titles being borrowed. Given the audiobook market’s continued Australian and international growth, information about availability, popularity, and representation hold value for industry practitioners and for scholars exploring changes to public book culture.

Background

Research into audiobooks is piecemeal. Major recent studies include Rubery’s (2016) examination of their historical development in the United States (US) and Have and Pedersen’s ( 2016, 2020) conceptualisations of the digital audiobook’s relationship to print media, grounded in qualitative interviews with Danish producers and readers and self-reported publisher data made available by the US-based Audio Publishers Association.

These studies lay important groundwork for exploring contemporary digital audiobooks’ production and reception. Surveying audiobooks’ historical development demonstrates their important cultural role in disseminating books to varied audiences, but also that they tend to have been seen as derivative modes of circulation of print and consequently treated as less interesting or important to study (Rubery, 2016). Where these two perspectives intermingle, audiobooks’ dismissal becomes a matter with significant political valence: they are simultaneously an accessibility aid and an overlooked and disparaged cultural form. This issue is well-recognised by pedagogical researchers in particular. Extensive research into audiobook usage in educational contexts has a particular focus on ‘teaching blind and print-disabled students, second-language learners, adolescent “reluctant readers”, and other groups who are unable to “efficiently access the printed page”’ (English, 2020, p. 420).

Small studies of contemporary audiobook readers in the general population (Have and Pederson, 2016) assert audiobooks’ value to time-poor readers, such as those with long car commutes. This dovetails with industry understanding of the demographics to which contemporary digital audiobooks particularly appeal. This includes traditionally under-served populations: for example, publishers have identified male truck drivers as key constituents driving market growth (Osborne, 2017). Another unexpected constituency has been ‘achievement-oriented young men, who listen to business and self-improvement titles on the treadmill at the gym’ (Martyn, 2019).

As noted above, while researchers have attempted to substantiate these kinds of claims (for example by partnering with publishers and distributors), the data they have been able to access has tended to be incomplete. Wallin and Nolin (2020) is one of the few quantitative studies of audiobooks. While they obtained detailed information about average users’ habits across demographics from Swedish distributor Bookbeat, they were unable to access information about the size of the user base, or the proportional differences between users of the different demographics they studied (including age and sex). As a result, while they conclude, for example, that ‘reading practices of men and women are very similar, with men even reading slightly more than women’, this is based on information provided about the average male reader in the Bookbeat system. There is no indication of whether the population overall contained equal, greater or lesser numbers of readers of different ages or sex; or indeed of how these data about age and sex are collated for the population.

Libraries, like publishers, have seen a marked increase in audiobooks’ popularity. Libraries report audiobooks are increasingly important parts of their e-resource collections, measured by spending and circulation. Like e-books, digital audiobooks support libraries to fulfil core missions, including ensuring equity of access for users requiring accommodations for visual impairment; users with mobility issues; remote and regional populations; and shift workers (Giblin et al., 2019a; Sieghart, 2013; Stern, 2011). Libraries make e-books and digital audiobooks available through aggregators such as Overdrive, with borrowing through aggregators generally subject to licensing arrangements. These licenses are predominantly either metered (by time, or by number of loans) or stipulate that only a certain number of users can access a book concurrently.

Audiobooks’ connection with libraries has a long history. While the earliest recordings of literature were novelty items produced in the 1870s, talking books became widespread as practical accessibility aids in the 1930s (Camlot, 2003; Rubery, 2016, p. 30). Advancements in recording technology facilitated these developments, as did (in the US) the establishment of the National Library Service for the Blind and Physically Handicapped in 1931 (Rubery, 2016, pp. 64, 112). While research into the history of audiobooks outside the US is scant, work in smaller markets, predominantly Denmark, shows similar parallels between libraries’ public access missions and audiobooks’ early development, with commercial markets only emerging later in the twentieth century (Have and Pedersen, 2020, p. 412). Up until this point, the audiobooks available in library collections required a succession of bulky and often out-of-date physical media (records, cassettes, or CDs) to be stored, maintained, and circulated. As digital technologies made audiobooks more portable and less expensive, new markets emerged. Increasingly, people not obliged to consume books aurally due to a disability or impediment nonetheless choose to, with younger listeners in particular driving uptake (Anderson, 2017).

Method

Our research explores data about audiobook borrowing through Australian libraries, using e-books as a comparison. We analyse 555,618 audiobook checkouts and 3,475,188 e-book checkouts through the leading library distribution platform, OverDrive. Our data were obtained through partnership with four Australian state and territory library services: the Australian Capital Territory (hereafter, the Capital Territory), South Australia, Tasmania, and Western Australia.

These data provide unprecedented information about audiobook circulation. They include every OverDrive checkout for every Australian state and territory that centrally licenses digital content for lending (in other states, licensing is via local council areas). At the 2016 census, these states and territories recorded a combined population of 5,197,800: about 21% of Australia’s total population (Australian Bureau of Statistics, 2017). Western Australia and South Australia are substantially larger than Tasmania and the Capital Territory: Western Australia had a population of approximately 2.56 million in 2016 and South Australia about 1.71 million.

The dataset, collected during the final week of July 2017, represents the entirety of e-books and audiobooks borrowed through OverDrive by users of these library services at that point. The longest-running subscription to OverDrive, by the Capital Territory, commenced in 2006. Tasmania subscribed in 2010; South Australia and Western Australia in 2012. Consequently, our data are most comprehensive for 2012–2016. For the purposes of our analysis below, we have chosen to look at all data up to the end of 2016 when making year-on-year comparisons, as the data for 2017 is partial. Where we do not segment the data by year, for example, in discussing overall popularity of different titles and imprints, we use the entire dataset.

Supplied by the library services individually, the raw data consist of one record per checkout. Each record includes the book title, author, publisher, language, and time and date of checkout. Our dataset also contained metadata about titles’ subject and audience, but our partners had warned us it was of mixed quality and we ultimately disregarded it due to classification inconsistencies. The raw data also include a unique identifier for each borrower. To maintain patron privacy, all user identifiers were salted and hashed at data acquisition, ensuring users could not be reidentified. Lastly, the data include information about title licenses. This has previously formed the basis for a study of availability, licence terms, and prices of books available in e-book or audiobook format in Anglophone public library systems around the world and so was not included in this analysis (Giblin, 2019a, 2019b). We used SQL to query the data to support this analysis.

We enriched the dataset by adding additional information, including categorising titles published by the Big Five publishers (Simon & Schuster, Macmillan, HarperCollins, Hachette, and Penguin Random House) and their imprints. We assigned a probable sex to each author, using the Genderize.io API and only retaining predictions with a confidence level of 95% or above, consistent with established practice for use of social media-derived sex prediction tools (Holman, et al., 2018; Wais, 2016). This approach assumes most names in the dataset are of Western origin; services like Genderize do not perform well with, for example, Chinese names, where first names are often not sex-related. Lastly, for the 100 most borrowed audiobook titles, we manually gathered information about publicly known and acknowledged author sex, author nationality, date of first publication, and genre. This can be used to benchmark how well Genderize performs. The most-borrowed titles included forty-six titles written by female authors; fifty by male authors; and four by collaborative pairings. Setting aside the collaborative pairings (which Genderize categorises male or female by first-named author) there were no misclassifications. In total, seventy-two of the authors were correctly classified. Three female authors’ names and five male authors’ names did not meet our 95% confidence threshold. Sixteen authors (nine female and seven male) use initials instead of their first name (including J.K. Rowling and J.R.R. Tolkien, both heavily represented in the sample); Genderize classifies these as unknown.

We queried the data to obtain information about the number of unique titles and number of checkouts in the dataset and compared these with bibliographic characteristics. These included title and publisher and the additional information about publisher characteristics and author sex we had added to the dataset. We broke these data down by year and by library service to track patterns over time and ensure we were comparing like data with like. We also compared the results obtained from each stage of this analysis for audiobooks with those for e-books, in order to understand how access to and popularity of each medium have followed distinctive trajectories of development.

Results

Title availability and popularity

Our first set of results relates to the overall number of unique titles available, and number of checkouts, through each library service per year. We also compare these metrics by considering the number of checkouts per available title. In reporting on these results we aim to provide a sense of the scale of uptake (particularly early uptake) of audiobook services and through this contextualise our more granular analysis of publishers and titles.

We are also interested in the number of unique titles available, to give us an idea of the size of the different collections. Because of the structure of our dataset, described above, only titles borrowed at least once are represented: we do not have information about the number of audiobook or e-book titles that these libraries have available that were never borrowed over the collected period. Thus we use number of distinct titles ever borrowed in year x as a proxy for unique titles available in the collection in year x. We expect that proxy to be stable across library collections and across audiobook vs. e-books, providing a consistent relative comparison.

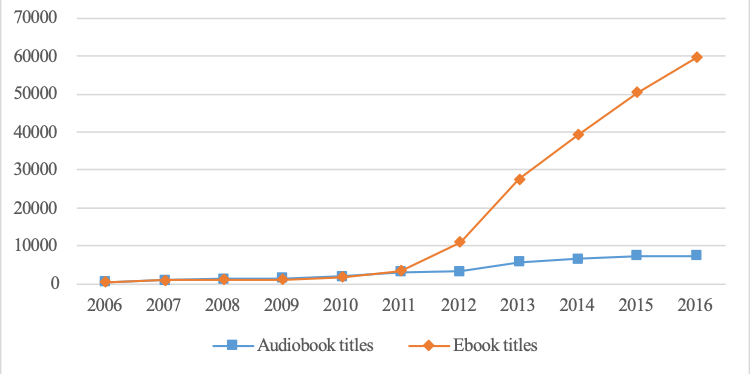

Figure 1 depicts the number of titles available for the two different formats over time. The accelerated growth rate for both after 2012 is partly explained by the addition of South Australia and Western Australia.

Figure 1: Number of unique audiobook and e-book titles available, per year

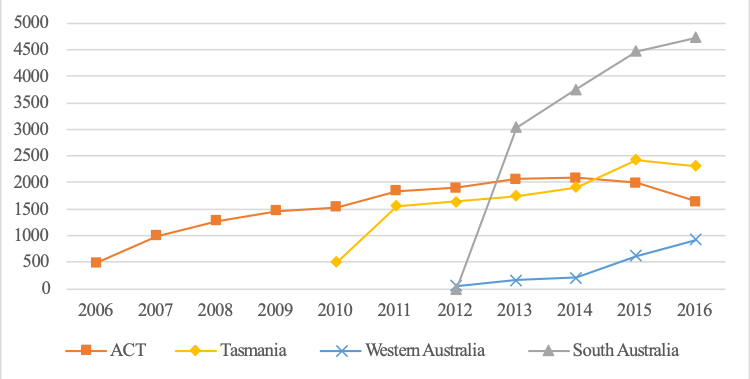

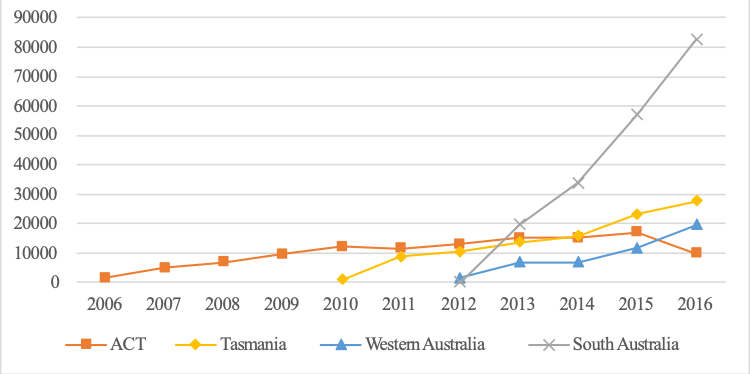

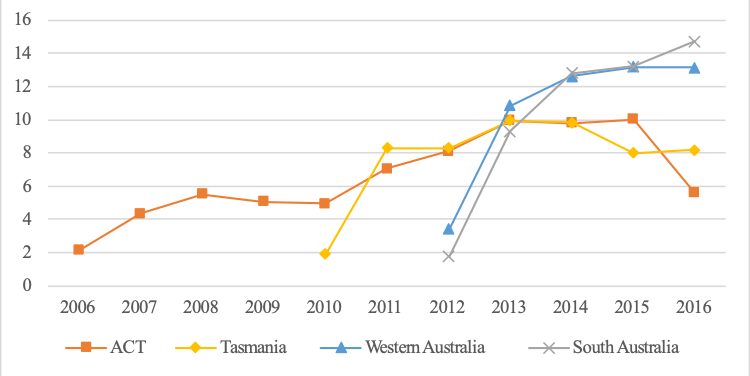

Figures 2 and 3 break this down to show the number of unique titles available across each library service. Overall, the audiobook and e-book titles available to library patrons have grown every year, with e-book collections growing much faster than audiobooks. This is particularly true of Western Australia, which demonstrates the most significant disparity in early acceleration between e-book and audiobook titles available.

|

|

Although overall growth continued on an upwards trajectory across the whole period studied, the number of unique audiobook and e-book titles in the Capital Territory library system declined slightly in 2015 and 2016 and Tasmania’s audiobook offerings also fell off slightly in 2016. We hypothesise this shift c.2015–2016 is representative of diversification of the playing field beyond OverDrive, rather than an actual decrease in title availability from patrons’ perspectives. Several other aggregators entered or upscaled participation in these markets around this time, most notably Bolinda, whose mobile application BorrowBox won the 2013 Australian Book Industry Award for innovation (2013 ABIA..., 2013) and was adopted in the Capital Territory in 2015 (Black, 2016). From 2006 to 2015 several Bolinda-produced titles were in fact available through OverDrive (peaking in 2010 with 161 titles checked out 836 times). By 2016, Bolinda no longer appears in the dataset.

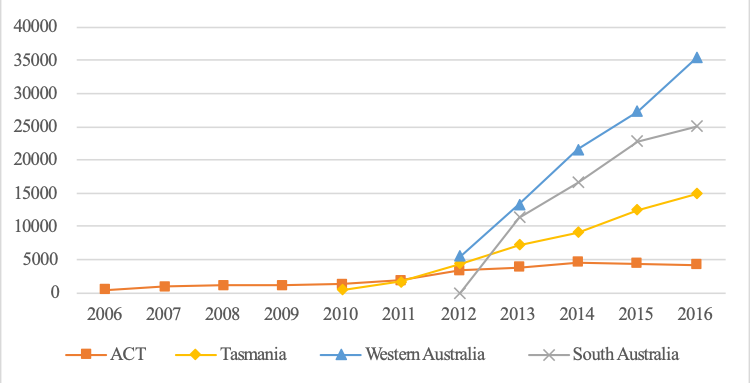

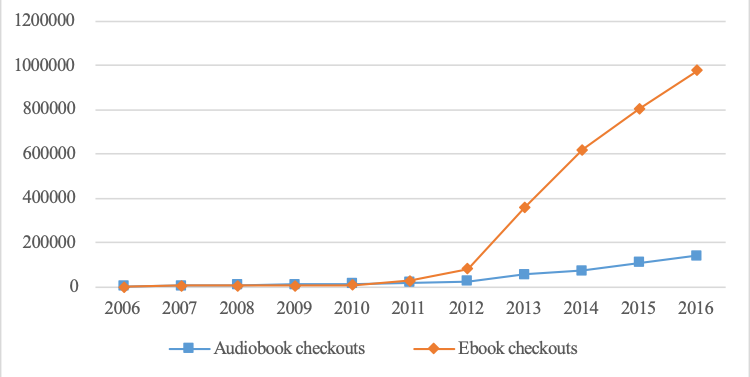

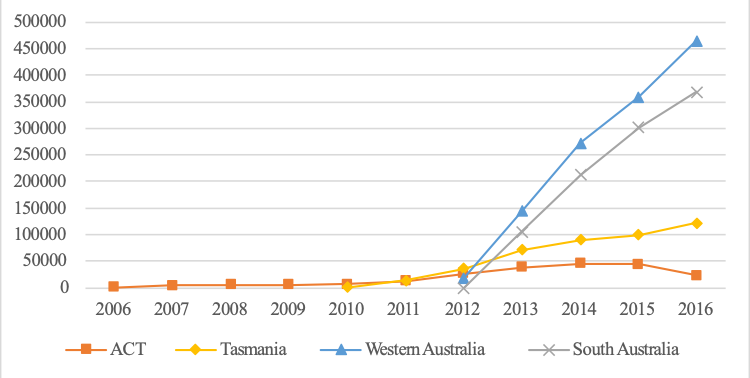

Figure 4 depicts the overall number of checkouts for each format, per year. As with the titles available, the accelerated growth rate post-2012 corresponds with South Australia’s and Western Australia’s take-up of OverDrive. As a point of comparison, 100,000 checkouts per year, which audiobooks exceeded for the first time in 2015, equates to 274 checkouts per day. If our sample of 21% of the Australian population is representative, this would correspond to 1,305 checkouts per day Australia-wide through OverDrive alone.

Figure 4: Audiobook and e-book checkouts, per year

Figures 5 and 6 break this down to show the number of checkouts across each library service. We see year-on-year increases in the number of checkouts of both audiobooks and e-books through three of the four, with audiobook checkouts in South Australia particularly notable. Tasmania‘s audiobook checkouts continue to increase, despite the titles available decreasing slightly, as noted above (Figure 2). Again, the slight downturn in both audiobook and e-book checkouts in the Capital Territory directly corresponds with their subscription to the BorrowBox service. We know from Black ( 2016) that audiobooks, overall, continued to grow in popularity in the Capital Territory post-2016: these figures again suggest a diversification of the field away from Overdrive rather than decreased overall usage.

|

|

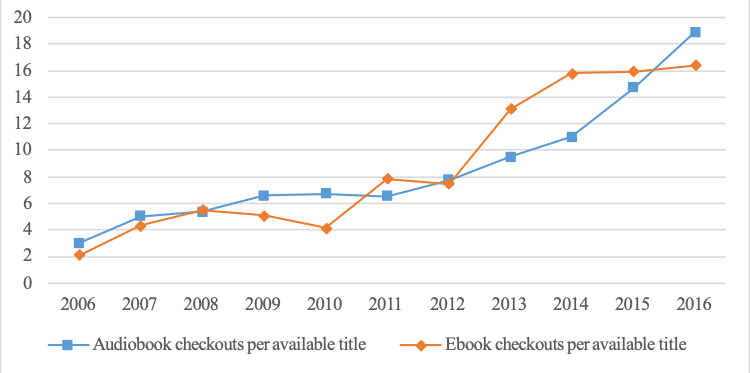

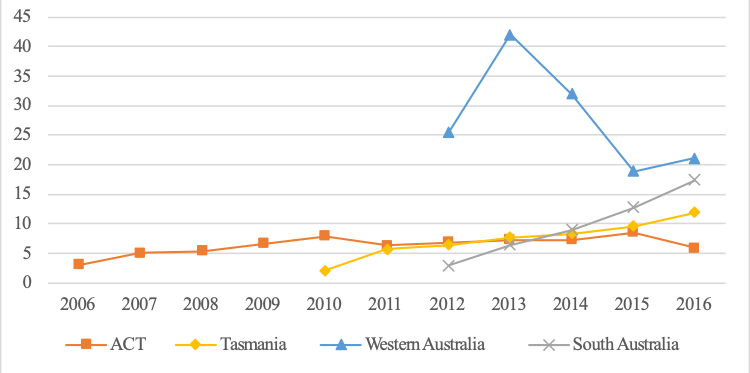

Our last piece of big-picture contextualising information is a comparison between the number of titles and the number of checkouts. We explore this by calculating the number of checkouts per title. Figure 7 looks at the overall checkouts per available title for each format, per year, with Figures 8 and 9 breaking this down to show the number of checkouts per available title across each library service for audiobooks (Figure 8) and e-books (Figure 9). Libraries often buy multiple licences for popular titles to service patron demand. However, this dataset does not contain information about the number of licenses held by each library. Accordingly, the figures we report here are the raw numbers of checkouts per year per available title, not adjusted by the number of copies held.

|

|

While Figure 7 demonstrates that, overall, the number of checkouts per available title has grown relatively steadily for both formats over this period, individual library services’ patterns suggest a more complex narrative. The fluctuations depicted in these charts, particularly when taken together with Figures 1–6, correspond with unequal increases in both availability and popularity as the different services explore options, develop collections at different rates, and as the private e-book and audiobook markets become increasingly complex.

Taking Figure 7 at face value, audiobooks look to be on a continued upwards trajectory, with e-books’ continued growth starting to slow as supply outstrips demand. Figures 8 and 9 reinforce the key differences between different library services’ approaches, particularly in the extremely high number of checkouts per available title for audiobooks in the West Australian library service in 2012–2014. As comparisons between Figures 2 and 3, and Figures 5 and 6, demonstrate, Western Australia’s collection included a relatively small number of audiobook titles, both in comparison to their e-book titles and in comparison to the other library services. While their audiobook checkouts also did not grow at rates comparable to their e-book checkouts (or to other services’ audiobook checkouts), this was likely due to the borrowing limitations posed by title availability, with demand driving increased supply in subsequent years. Lastly, turning to the Capital Territory, both media forms’ respective drops in checkouts per title and the overall drop in checkouts in the Capital Territory from 2015 to 2016 were pre-empted by drops in availability in audiobooks and e-books. Looking at each of these three metrics together shows that a decrease in title availability pre-empted decreases in demand (both in absolute and per-available-title terms), rather than the other way around, which again confirms the likelihood of additional market players being the key influencing factors in these changes.

Publishers

We broke down our datasets by information about different publisher types in order to explore differences in how audiobook and e-book markets function. Overall, there were 690 different imprints indicated in the dataset. Of these, the vast majority were associated with only one of the media types. Eighty-nine, or 13% of the imprints were only associated with audiobooks; 544, or 79% were only associated with e-books. The more popular imprints, however, were those associated with both media formats: these fifty-seven imprints (roughly 8% of the total number) accounted for 42% of e-book checkouts and 72% of audiobook checkouts.

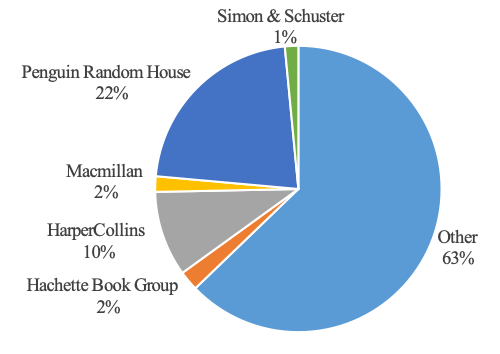

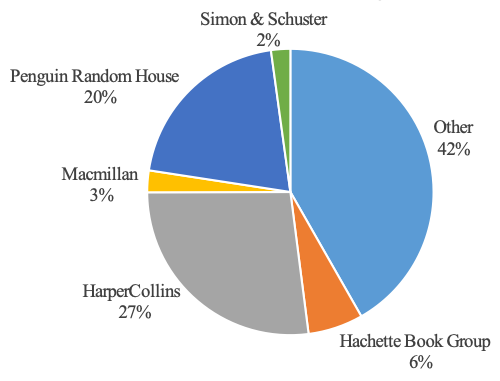

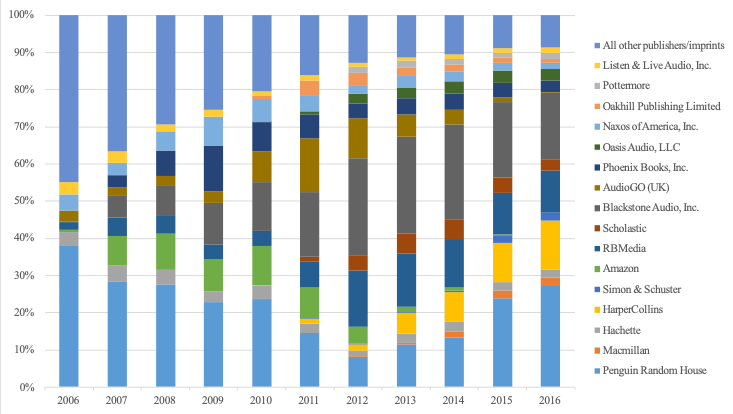

Based on our manual coding, seventeen of the imprints publishing audiobook titles and thirty-three of the imprints publishing e-book titles were subsidiaries of Big Five publishers. Our categorisation of imprints’ affiliation with the Big Five, other publishers, or other large companies, was on the basis of ownership at the end of the data collection period. This means that, for example, Perseus is classified as Hachette (acquired 2016); imprints acquired by Recorded Books in 2014 and later merged to form RBmedia are classified RBmedia. We acknowledge this leads to some overstating of the prominence of major players in early years of the dataset and have sought to mitigate this by retaining details of individual imprints, for example in the list of top twenty most checked out imprints (Table 1). Figures 10 and 11 show the breakdown of checkouts associated with imprints of each of the Big Five.

|

|

As these figures demonstrate, the Big Five account for substantial shares of both audiobook checkouts (37%) and e-book checkouts (58%), with particular dominance in e-book publishing. Penguin Random House is the most significant of the Big Five in terms of audiobook checkouts, with its imprints accounting for 22% of checkouts overall.

The most substantial of e-book publisher is HarperCollins, enjoying 27% of e-book checkouts overall. E-books published by their romance divisions Harlequin and Harlequin Australia were checked out 349,532 times, corresponding to roughly 37% of HarperCollins’ total e-book checkouts. We note that Hachette has sometimes made e-books available through OverDrive for library e-lending and this is captured in our dataset. For the bulk of the years captured, Hachette has refused to license e-books to libraries in the British Commonwealth (though does license them to North American libraries). Hachette does however license audiobooks into these libraries.

Looking in a more granular way at the publishers represented in these datasets, however, reveals important differences between e-book and audiobook publishing. The following tables (Tables 1 and 2) list the top twenty audiobook and e-book imprints (where top equates to each imprint’s total number of checkouts). We include in these tables information about the type of publishing house they belong to, the specific publisher or parent company affiliation, the publisher location (if not multinational) and other contextual notes about the imprint or parent.

| Checkouts | Imprint | Publisher type | Publisher affiliation | Location | Notes |

|---|---|---|---|---|---|

| 111,756 | Blackstone Audio, Inc. | Audiobooks only | US | Oregon-based independent audiobook publisher, established 1987. | |

| 62,539 | Random House Group Limited | Big Five | Penguin Random House | ||

| 58,988 | Books on Tape | Big Five | Penguin Random House | Imprint of Random House, acquired 2001. | |

| 43,488 | Tantor Media, Inc. | Other affiliation | RBmedia | US | Tantor established as independent audiobook publisher in 2001. Acquired in 2014 by Recorded Books, which became audiobook conglomerate RBmedia in 2017 as part of a larger merger process (Maughan, 2017). |

| 41,706 | HarperCollins Publishers Inc. | Big Five | HarperCollins | ||

| 21,726 | Phoenix Books, Inc. | Independent | US | | Los Angeles-based independent publisher; closed suddenly in 2010 (Milliot, 2010). |

| 18,542 | Scholastic Inc. Audiobooks | Other affiliation | Scholastic | Major multinational publisher. | |

| 15,845 | Oasis Audio, LLC | Audiobooks only | US | Predominantly Christian publisher. | |

| 15,272 | AudioGO (UK) | Audiobooks only | UK | Audiobook publisher including of BBC titles; went into administration in 2013, at which point their non-BBC titles were sold to Audible. BBC audio titles are now licensed through Penguin Random House. | |

| 12,944 | Naxos of America, Inc. | Other affiliation | US | Audiobook ‘label' produced by record company Naxos. | |

| 12,397 | Hachette Audio | Big Five | Hachette | ||

| 9,749 | Macmillan Audio | Big Five | Macmillan | ||

| 8,772 | Oakhill Publishing Limited | Audiobooks only | UK | English audiobook publisher established in 2005; since acquired in 2018 by Ulverscroft, a UK publisher of audio and large-print titles (Wood, 2018b). | |

| 8,435 | Simon & Schuster - All Library | Big Five | Simon & Schuster | ||

| 7,855 | Brilliance Audio, Inc. | Other affiliation | Amazon | US | Audiobook publisher acquired by Amazon in 2007; as of 2018, Brilliance titles were to be distributed digitally through Audible with CD distribution through Blackstone (Kozlowski, 2018). |

| 7,742 | Pottermore | Audiobooks only | UK | Harry Potter distributor for e-books and digital audiobooks from 2012 onwards | |

| 7,027 | Listen & Live Audio, Inc. | Audiobooks only | US | Independent audiobook publisher. | |

| 7,020 | Zondervan | Big Five | HarperCollins | US | Imprint of HarperCollins dedicated to Christian publishing. |

| 5,555 | HighBridge Company | Other affiliation | RBmedia | US | Incorporated 1980s as distributor for recordings of Minnesota radio show Prairie Home Companion. Acquired in 2014 by Recorded Books, which became audiobook conglomerate RBmedia in 2017 as part of a larger merger process. |

| 5,210 | Christian Audio, LLC | Other affiliation | RBmedia | US | Formerly independent Christian publisher established in 2004; became part of RBmedia as part of 2017 merger. |

| Checkouts | Imprint | Publisher type | Publisher affiliation | Location | Notes |

|---|---|---|---|---|---|

| 373,494 | Random House, Inc. | Big Five | Penguin Random House | ||

| 305,419 | Harlequin Enterprises Australia | Big Five | HarperCollins | Australia | |

| 243,338 | HarperCollins Publishers Inc. | Big Five | HarperCollins | ||

| 217,348 | HarperCollins Publishers Ltd. | Big Five | HarperCollins | ||

| 217,338 | Random House Group Limited | Big Five | Penguin Random House | ||

| 181,776 | Allen & Unwin Pty Ltd | Independent | Australia | Major Australian independent publisher. | |

| 142,558 | Perseus Books Group | Big Five | Hachette | Perseus was acquired by Hachette in April 2016. | |

| 76,224 | Samhain Publishing, Ltd. | Independent | US | Mostly digital romance publisher; ceased operation in 2017 ‘due to a steady decline in e-book sales' (Reid, 2016). | |

| 75,640 | Simon & Schuster, Inc. | Big Five | Simon & Schuster | ||

| 64,228 | Hachette Livre UK | Big Five | Hachette | UK | These books were acquired during a period when Hachette did license e-books into Australian libraries. As they were licensed on perpetual one copy, one user terms, they remained within library collections and kept circulating even after Hachette stopped licensing new titles. |

| 63,161 | HarperCollins Australia | Big Five | HarperCollins | Australia | |

| 59,568 | Macmillan Publishers Australia | Big Five | Macmillan | Australia | |

| 59,224 | Source-books | Independent | US | Major independent book publisher based in Naperville, Illinois. | |

| 57,656 | The Text Publishing Company | Independent | Australia | Major Australian independent publisher. | |

| 56,919 | Baker Publishing Group | Independent | US | Christian book publisher based in Ada, Michigan. | |

| 56,569 | ePub Direct | Distributor | Ireland | Cork-based publisher; primarily distributor of e-books and provider of digital publishing services. | |

| 54,467 | Random House Australia | Big Five | Penguin Random House | Australia | |

| 53,042 | Severn House Publishers Ltd | Independent | UK/USA | Acquired by Canongate in 2017. | |

| 48,244 | Smashwords, Inc. | Self-publishing platform | US | Major self-publishing platform | |

| 45,025 | Ellora's Cave Publishing Inc. | Independent | US | Mostly digital US-based erotic fiction publisher; ceased operation in 2016 after several years' decreases in revenue; peaked c. 2012 (Reilly, 2015). |

Looking at the top twenty e-book imprints, the major players reflect those in print publishing. Ten of the top twelve are imprints or subsidiaries of the Big Five and other major independent publishers are also included in the lists. Notable among these, given the Australian dataset, are major Australian independents Text and Allen & Unwin; other independents include US-based Sourcebooks, and Severn House, acquired by Canongate in 2017. A key difference between e-book and print publishing is the presence in this top twenty of digital-only romance publishers Ellora’s Cave and Samhain, self-publishing platform Smashwords, and Christian publisher Baker. The prominence of Samhain and Ellora’s Cave, as well as romance publisher Harlequin (number two on the list, owned by HarperCollins since 2014 and perhaps most notably the publisher of Mills and Boon titles), speaks to romance’s affinity with e-book, self-publishing and hybrid publishing models. This has shown itself in a massive increase in the romance titles published and read since the advent of the e-book (Driscoll, et al., 2018). Despite this, both Samhain and Ellora’s Cave have recently ceased operation (in 2017 and 2016 respectively), each citing decreased sales as the reason. The owner of Ellora’s Cave, Tina Engler (pen name Jaid Black) directly attributed this decrease in sales to Amazon’s increasing presence in digital publishing (Reilly, 2015).

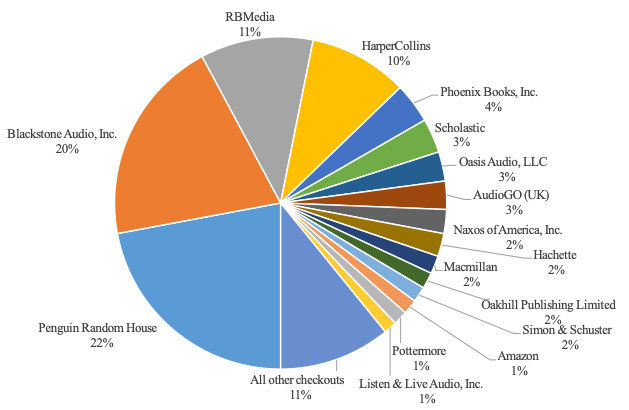

The top twenty audiobook imprints suggest a more complex playing field. Where the top of the e-book list (and the top of similar sales lists for print publishing) is controlled by the Big Five, other players are equally or more competitive in audiobook publishing. Audiobook specialist Blackstone and audiobook conglomerate RBmedia are both dominant. Blackstone’s 111,756 checkouts account for 20% of checkouts and RBmedia’s subsidiaries between them accrued 61,000 or nearly 11% of checkouts.

Other top twenty imprints have ties to established audio production companies outside publishing. Naxos is a major US record label; AudioGO (UK) and Highbridge are both closely linked to radio producers (although both have since been subsumed by a combination of the Big Five, Audible and RBmedia).

Pottermore, the dedicated publisher of Harry Potter materials including audiobooks of the series, also features prominently. Lastly, the audiobooks top twenty also includes three imprints dedicated to Christian publishing (Oasis, Zondervan and Christian Audio). Zondervan is an imprint of HarperCollins; Christian Audio was one of the imprints subsumed by RBmedia during the 2017 merger process (Maughan, 2017).

Figure 12 illustrates how these publishers structure the field by depicting the percentage share of checkouts of the Big Five publishers, together with those of the other conglomerate publishers (RBmedia, Scholastic, and Amazon) and other imprints represented in the top twenty (Blackstone, AudioGO (UK), Phoenix, Naxos, Oakhill, Pottermore, and Listen & Live). As this Figure illustrates, between them these publishers and imprints account for approximately 89% of checkouts overall.

Figure 12: Audiobook checkouts per Big Five publishers and other top twenty publishers and imprints

Blackstone’s and RBmedia’s respective market shares put them behind only Penguin Random House. RBmedia (2020) describes itself as ‘the largest audiobook producer in the world’. As of 2018, it is owned by hedge fund KKR, which in 2019 also signed an agreement to acquire OverDrive (KKR, 2019). As well as publishing audiobooks for distribution as digital audiobooks through OverDrive and a range of other third-party platforms, Blackstone has historically been and continues to be a major distributor of ‘physical audiobook products’ (e.g., CDs), including for Big Five publishers Hachette and HarperCollins (see Blackstone Library, 2021). At the end of 2019, Blackstone announced a new embargo agreement with Amazon that would see its titles available exclusively on Audible for 90 days following publication, leading to boycotts by a number of US libraries (Albanese, 2019a).

Examining how this breakdown of the field has changed over time illustrates the growing dominance of these major figures. Figure 13 depicts the percentage share of checkouts of the same sixteen publishers and imprints from 2006-2016.

Figure 13: Audiobook checkouts per Big Five publishers and other top twenty publishers and imprints, over time

As this figure shows, only seven of these publishers or imprints (Penguin Random House, Hachette, Amazon, RBmedia, Blackstone, AudioGO (UK), and Naxos) were represented in our dataset in 2006, with other imprints not in the top twenty accounting for 44.8% of checkouts.

Turning first to the Big Five, Penguin Random House dominated the relatively small market in 2006, with 566 or 38% of checkouts. In actual terms their checkouts grew until 2010, dropped in 2011 and 2012, and then grew substantially until 2016. Looking at percentage share, however, their dominance decreased sharply from 2006 to 2012, at which time their 2,025 checkouts accounted for 8.1% of the total number, behind Blackstone (6,491), RBmedia (3,786) and AudioGO (UK) (2,690). Since 2013 they have regained their lead, overtaking Blackstone in 2015 and in 2016 recording 37,937 checkouts (27.2%). HarperCollins, the second largest of the Big Five represented in the dataset, only enters play in 2010; in 2013 they recorded 3,011 checkouts (5.5% of the total number) and then continued to grow relatively quickly year-on-year, recording 18,617 checkouts (13.3%) in 2016.

Blackstone and several of the imprints that would later become RBmedia were both already represented in the dataset in 2006 but were not yet major players. In absolute terms, both saw growth every year from 2006 to 2016, with Blackstone enjoying faster growth particularly in early years. Blackstone’s peaked at 26.2% in 2014, recording 14,373 checkouts. RBmedia peaked at 15% in 2012 with 3,786 checkouts. In 2016, Blackstone recorded 25,195 checkouts (18%) and RBmedia 15,439 checkouts (9.8%).

There are also several publishers and imprints that vanish over the data collection period. AudioGO (UK), whose share of checkouts peaked in 2011, went into administration in 2013. Phoenix Books closed suddenly in 2010, but although their share dropped in 2011, it remained not huge but surprisingly steady across the rest of the period.

Perhaps the most notable disappearance, however, is Amazon, primarily represented in the dataset under the imprint Brilliance Audio. (The imprint Rooftop Media is also categorised as an Amazon subsidiary, as they were acquired by Audible in 2014. Seven titles from Rooftop were available from 2013 to 2017; these were checked out 94 times.) As noted above, Amazon acquired Brilliance in 2007 (Kozlowski, 2018); before this, Brilliance was ‘the largest independent publisher of audiobooks in the United States’ (Amazon.com, 2007). Amazon’s checkouts grew year-on-year until 2011, when it recorded 1,674 checkouts (8.2%). Its percentage share of checkouts peaked a year earlier, in 2010, in which it recorded 1,401 checkouts (10.6%). After growing from 2006 to 2011, the number of unique titles published by Brilliance and Amazon in the dataset remained relatively steady from 2011 to 2014 and declined slightly in 2015. In 2016 and 2017, Brilliance was not represented in the dataset at all; by 2018, all of its digital distribution was through Audible (Kozlowski, 2018).

Distribution of authors by sex

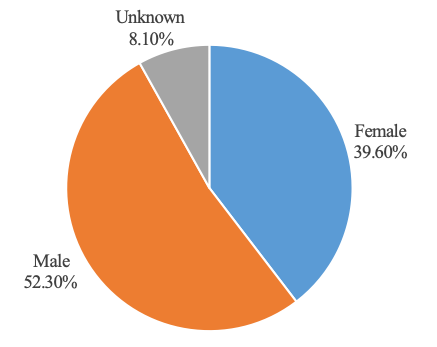

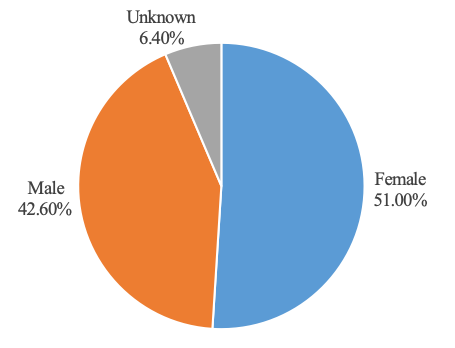

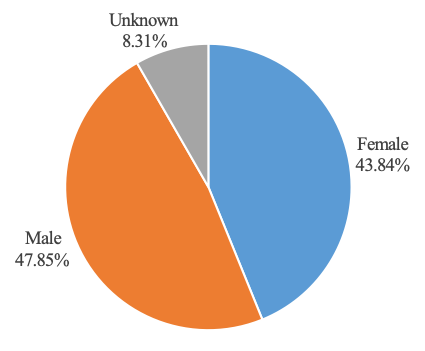

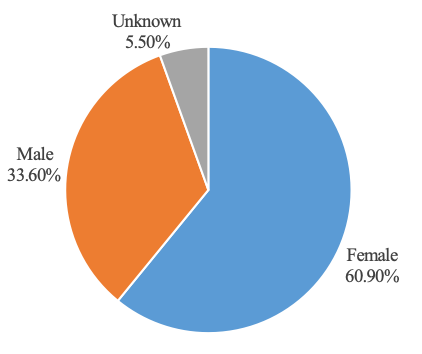

As noted above, we used Genderize to determine the likely sex of the authors of e-books and audiobooks in the collection, as another means of offering more granular understanding of the patterns of circulation and popularity. Figures 14–17 show the percentage breakdown of audiobook titles, e-book titles, audiobook checkouts, and e-book checkouts, between authors who are likely female, authors who are likely male, and authors whose sex is unknown.

|

|

|

|

These charts demonstrate uneven breakdowns between the representation and popularity of female and male authors, which play out differently between audiobooks and e-books. There are more audiobooks with male authors than female authors in the collection (Figure 14: 52.3% male authors, 39.6% female authors), whereas for e-books this ratio is almost reversed (Figure 15: 42.6% male authors, 51% female authors). Audiobooks with male authors account for more checkouts than audiobooks with female authors, although the audiobook checkouts are significantly more balanced between male and female authors than the number of titles (Figure 16: 47.85% male authors, 43.84% female authors). The breakdown of e-book checkouts by gender follows on from that of e-book titles, in that female authors are more popular than male authors; this ratio is skewed even further (Figure 17: only 33.6% male authors as opposed to 60.9% female authors). Looking at the number of checkouts per available title, audiobooks by women are the most popular, with a cumulative average of 63.6 checkouts per available title; followed by e-books by women (55.5), audiobooks by men (50.3) and e-books by men (34.1).

In other words, titles authored by women tend to be borrowed more often than titles authored by men. This is the case both for audiobooks, where there are more male-authored titles available in the collection; and for e-books, where there are more female-authored titles.

Top 100 titles: author’s sex and nationality

We enriched the supplied data for the top 100 audiobook titles (with top again measured by number of checkouts) with additional manually collected demographic and bibliographic data including author gender, nationality, title’s genre, audience, and date of first publication (see Appendix: we have also made this full enriched subset of data publicly available.)

Forty-six of these titles were authored by women, fifty by men and four by cross-sex collaborations. All seven Harry Potter titles are represented, with 7,675 checkouts among them. Seven of Peter Robinson’s Chief Inspector Banks crime titles are also in the top 100, with 6,374 checkouts collectively. Comparing this to the entire dataset of 10,078 titles, we find Agatha Christie to be the most prolific and popular author (sixty-five titles; 10,372 checkouts), followed by James Patterson (forty-four titles; 6,945 checkouts). Other prolific authors include P.G. Wodehouse (forty-one titles), Shakespeare (thirty-six) and Orson Scott Card (thirty-one), with children’s author Jacqueline Wilson, crime authors Kathy Reichs and Lee Child and Christian fiction author Terri Blackstock each with thirty titles.

In terms of nationality, fifty-two of the top 100 titles were authored by Americans, thirty by Britons and ten by Canadians. Just two titles by Australian authors make the top 100: Stephanie Laurens’ Beyond Seduction (a 2007 romance novel that is book six of her Bastion Club series) and crime author Kerry Greenwood’s Out of the Black Land (an historical mystery published in 2007). One of Melbourne-based Northern Irish crime author Adrian McKinty’s Sean Duffy series, The Cold, Cold Ground, is also in the top 100. The rest of the world is represented by one title apiece by Gabriel García Márquez (Colombia), Eckhart Tolle (Germany), William Trevor (Ireland), Leo Tolstoy (Russia), and Henning Mankell (Sweden). While the prominence of US and UK authors in the dataset is unsurprising given these countries’ dominance in global Anglophone publishing, the lack of Australian authors is notable given the data represents checkouts from Australian libraries. Without more comprehensive, multi-platform bibliographic data about audiobook publishing and distribution, it is difficult to confidently attribute this to any specific factor. However, we hypothesise that the nascence of audiobook publishing as an industry over the period of data collection and in particular the prominence of major competitor Bolinda in the Australian market are both contributing factors to local authors’ scant representation.

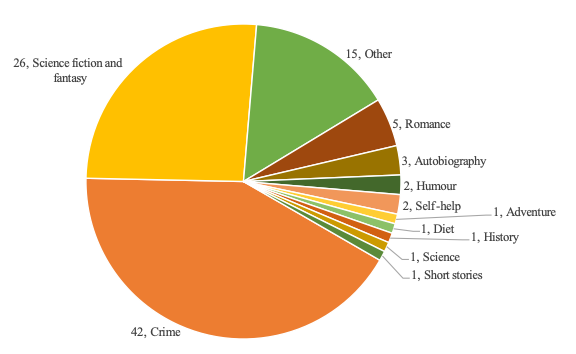

Although audiobooks are often associated with children’s books, we found that titles for adults are far more prominent in the top 100 (eighty-five titles compared to fifteen for children or young adults). Looking at a top-level genre categorisation, fiction is also far more prominent than non-fiction (ninety-two as opposed to eight titles). Numerous challenges are associated with translating visual-heavy children’s books and visual- or jargon-heavy non-fictional titles to audio, but this is also counter to more recent trends in audiobook publishing that have seen memoirs like Michelle Obama’s Becoming extremely prominent in audiobook bestseller lists. Without sales data, however, these trends are anecdotal rather than concrete (e.g., Holstrom, 2020). Figure 18 depicts more specific genre categorisations by percentage of the top 100 titles.

Figure 18: Genre of most popular 100 audiobook titles

Crime (forty-two titles) and science fiction and fantasy (twenty-six titles) are by far the best represented genres. The category Other, which includes titles that would likely fall into slippery categories of literary fiction, commercial fiction, and women’s fiction (and which we used in this instance to sidestep the value judgements these categories predicate), follows with fifteen titles. This category includes the single most popular audiobook title in the dataset, Nancy Thayer’s Beachcombers. Published in 2010 and checked out 1,747 times, it has been variously described as domestic fiction, general fiction, and commercial fiction by (respectively) Google and the authors’ local bookstore and library.

Other popular fiction and non-fiction genres are far less numerous in the top 100. These include romance (five titles) and autobiography (three titles). As discussed above, romance e-books have proliferated in recent years. E-book publishing and self-publishing have both helped break down barriers to entry for authors, who have additionally found support and readerships in thriving online communities centred on romance and erotic writing. Low production costs and faster production timelines as a result of digital distribution have supported that proliferation. By contrast, audiobooks are much more expensive to produce, requiring substantial expert labour for narration and editing. This may explain their relatively smaller share of the audiobook market.

The two largest genres are relatively balanced in terms of the sex of the authors. Of the forty-two crime titles in the top 100, eighteen are authored by women, twenty-one by men and three by cross-sex collaborations (one between James Patterson and Maxine Paetro, and two between Janet Evanovich and Lee Goldberg). Female authors account for thirteen of the science fiction and fantasy titles (J.K. Rowling again features prominently), male authors for twelve and collaborations for one (husband-and-wife team Ilona and Andrew Gordon, under pen-name Ilona Andrews). Ten of the fifteen other titles are by female authors and five by male authors. The other less-represented genres demonstrate unsurprising gender splits. All five of the romance titles are by female authors; two of the autobiographies are by male authors and one by a male collaboration (American Sniper: The Autobiography of the Most Lethal Sniper in U.S. Military History, by American Sniper Chris Kyle, with Scott McEwen and Jim DeFelice). Adventure and short stories (one title apiece) and all other non-fiction genres (diet (one title), history (one), humour (two), science (one) and self-help (two)) have only male writers.

Conclusion

Audiobook publishing is an evolving and deeply proprietary industry. Even publishers cannot access comprehensive, industry-wide data about the kinds of audiobook titles of greatest interest to readers. This dataset is one of the first to publicly and quantitatively spotlight trends in audiobook circulation.

Our aim in writing this paper was not to provide a representative account of audiobook (or e-book) publishing, but rather to explore a dataset that, although incomplete, has potentially less bias than self-reported or small-scale data, and with this to sketch the shape of this emerging and important sub-sector of publishing.

The data we have collected, analysed and reported on in this paper speak to major changes audiobook publishing has undergone since 2006. At the start of this period, the first iPhone was yet to be launched; a decade later, in 2016, two-thirds of the Australian population owned a smartphone (Statista, 2018), dramatically refashioning modes of access and consumption for audiobooks in particular. Our dataset captures the volatility in this publishing landscape, with sudden peaks as different library systems come on board. We show that over this period audiobook publishing was not controlled by the Big Five of print; other conglomerates posed real challenges to these established players, as did a range of independents; and there were close ties between audiobook publishing and non-publishing audio industries including radio and music production. The data strongly suggest that increased competition from other distribution platforms, such as Bolinda and Audible, has been an important recent influence, but measuring these platforms’ impact is beyond the scope of this paper.

Looking at genre and the sex of authors shows that audiobook titles have developed in a manner quite distinct to that of e-books. Audiobook titles are more likely to have male than female authors, and crime fiction and science fiction and fantasy are the most popular audiobook genres. Our data show audiobooks by female authors are more popular than audiobooks by male authors, and e-books by female authors are more popular than those by male authors. While we do not have demographic data for readers, other research has shown readers have strong preferences for books authored by their own sex (Thelwall, 2019). Consequently, claims that men are more prolific consumers of audiobooks than women (Wallin and Nolin, 2020) merit further investigation.

One of the biggest challenges facing the contemporary publishing industry is the power of Amazon: not only a major distributor but also a direct competitor, through its burgeoning self-publishing service and its audiobook production house Audible (now reputed to be the largest employer of actors in New York). It has real-time, granular data about nearly every publisher’s e-book and audiobook sales and its refusal to share that with the industry gives it a huge advantage. Simultaneously, leading library aggregator Bibliotheca has argued it is ‘“highly probable” that Amazon is using its data to suggest to authors and agents that libraries are bad for their retail sales’ (Albanese, 2019b). We counter this, suggesting libraries and publishers are natural allies in the battle to preserve publishing’s diversity and ensure continued public access to books. As this study shows, libraries also hold an important piece of the data puzzle. One way forward may be for libraries and publishers to collaborate more closely to achieve their shared aims.

About the authors

Millicent Webber is a Lecturer in English at the School of Literature, Languages and Linguistics at Australian National University in Canberra. She can be contacted at millicent.weber@anu.edu.au

Rebecca Giblin is an ARC Future Fellow and Associate Professor of Law at Melbourne Law School at the University of Melbourne and Adjunct Associate Professor of Law at Monash Law School at Monash University. This work was supported by funding from the Australian Research Council (LP160100387 and FT170100011). She can be contacted at rebecca.giblin@unimelb.edu.au

Yanfang Ding is a postgraduate student in the Faculty of Information Technology at Monash University in Melbourne. Ms Ding’s role included analysing and visualising the dataset, and was supported by a Monash University Faculty of IT Summer Scholarship. She can be contacted at yfding24@gmail.com

François Petitjean-Hèche is an Affiliate Senior Lecturer in the Faculty of Information Technology at Monash University in Melbourne. This work was mostly conducted while an ARC DECRA Fellow (DE170100037). He can be contacted at Francois.petitjean@monash.edu

References

Note: A link from the title is to an open access document. A link from the DOI is to the publisher's page for the document.

- 2013 ABIA winners announced. (2013, May 27). Books+Publishing. https://www.booksandpublishing.com.au/articles/2013/05/27/27264/2013-abia-winners-announced/ (Archived by the Internet Archive at https://bit.ly/2SC4FNF)

- Albanese, A. (2019a, July 12). Citing embargo, libraries plan boycott of Blackstone digital audio. Publishers Weekly. https://bit.ly/33pxbnQ (Archived by the Internet Archive at https://bit.ly/3nVtSy0)

- Albanese, A. (2019b, August 27). Bibliotheca calls out Amazon for meddling in the library e-book market. Publishers Weekly. https://bit.ly/3eqKKcQ (Archived by the Internet Archive at https://bit.ly/2Q2IE9U)

- Amazon.com. (2007, May 23). Amazon.com acquires Brilliance Audio. Business Wire. [Press release] https://bwnews.pr/3eWbgKk (Archived by the Internet Archive at https://bit.ly/3vQtN1m)

- Anderson, P. (2017, June 7). Audio Publishers Association: third year of strong US audiobook sales growth. Publishing Perspectives. https://bit.ly/33sBPl3 (Archived by the Internet Archive at https://bit.ly/33py93s)

- Australian Bureau of Statistics. (2017). Rebasing of Australia’s population estimates using the 2016 census. Australian Bureau of Statistics. https://bit.ly/3xSCVo1 (Archived by the Internet Archive at https://bit.ly/2R0A7oc)

- Black, J. (2016, July 16). ACT libraries turn to new programs as loans decline. ABC News. https://ab.co/3eZrRNn (Archived by the Internet Archive at https://bit.ly/3usWlxG)

- Blackstone Library. (2021). Knowledge base. Blackstone Library.com https://www.blackstonelibrary.com/kbase (Archived by the Internet Archive at https://bit.ly/3uoDfJ7)

- Camlot, J. (2003). Early talking books: spoken recordings and recitation anthologies, 1880–1920. Book History, 6, 147–173. https://doi.org/10.1353/bh.2004.0004

- Driscoll, B., Fletcher L., Wilkins, K., & Carter, D. (2018). The publishing ecosystems of contemporary Australian genre fiction. Creative Industries Journal, 11(2), 203–221. https://doi.org/10.1080/17510694.2018.1480851

- English, J. (2020). Teaching the novel in the audio age. PMLA, 135(2), 419–426. https://doi.org/10.1632/pmla.2020.135.2.419

- Giblin, R., Kennedy, J., Weatherall, K., Gilbert, D., Thomas, J., & Petitjean-Hèche, F. (2019a). Available, but not accessible? Investigating publishers’ e-lending licensing practices. Information Research, 24(3), paper 837. http://informationr.net/ir/24-3/paper837.html (Archived by the Internet Archive at https://bit.ly/3f5QxDO)

- Giblin, R., Kennedy, J., Pelletier, C., Thomas, J., Weatherall, K., & Petitjean-Hèche, F. (2019b). What can 100,000 books tell us about the international public library e-lending landscape? Information Research, 24(3), paper 838. http://informationr.net/ir/24-3/paper838.html (Archived by the Internet Archive at https://bit.ly/3b8GTiC)

- Have, I., & Pedersen, B. S. (2016). Digital audiobooks: new media, users, and experiences. Routledge.

- Have, I., & Pedersen, B. S. (2020). The audiobook circuit in digital publishing: voicing the silent revolution. New Media & Society, 22(3), 409–428. https://doi.org/10.1177%2F1461444819863407

- Holman, L., Stuart-Fox, D., & Hauser, C. E. (2018). The gender gap in science: how long until women are equally represented? PLOS Biology, 16(4), paper e2004956. https://doi.org/10.1371/journal.pbio.2004956

- Holstrom, A. (2020, May 8). The bestselling audiobooks of all time. Book Riot. https://bookriot.com/bestselling-audiobooks-of-all-time/ (Archived by the Internet Archive at https://bit.ly/3baOVrv)

- KKR to acquire leading digital reading platform Overdrive. (2019, December 24). Business Wire.https://bwnews.pr/3ersD6x (Archived by the Internet Archive at https://bit.ly/33mZSBF)

- Kozlowski, M. (2018, July 19). Brilliance Audio is closing their audiobook store. Good e-Reader. https://bit.ly/3nW3vYO (Archived by the Internet Archive at https://bit.ly/2SpbiCL)

- Martyn, S. (2019, December 27). Book trends of the decade: erotica, colouring books and Aussie noir. The Sydney Morning Herald. https://bit.ly/2R69KgF (Archived by the Internet Archive at https://bit.ly/2PZjCIJ)

- Maughan, S. (2017, May 26). How RBmedia came to life. Publishers Weekly. https://bit.ly/3bby9Ze (Archived by the Internet Archive at https://bit.ly/3uwMas6)

- Milliot, J. (2010, April 26). Phoenix Books closes. Publishers Weekly. https://bit.ly/3toGHSM (Archived by the Internet Archive at https://bit.ly/3h8qJJR)

- Osborne, T. (2017, July 3). Why Australia is all ears for audiobooks. ABC News. https://www.abc.net.au/news/2017-07-03/why-australia-is-all-ears-for-the-audiobook/8668202 (Archived by the Internet Archive at https://bit.ly/3f1JRGL)

- OverDrive. (2014, January 14). Libraries reach 102 million digital checkouts during record-breaking 2013. [Press release]. OverDrive. https://bit.ly/3haacFm (Archived by the Internet Archive at https://bit.ly/3eu2EeT)

- OverDrive. (2020, January 8.) Public libraries reach record-high ebook and audiobook usage in 2019. [Press release]. OverDrive. https://bit.ly/2QW1Zdq (Archived by the Internet Archive at https://bit.ly/3b95UdK)

- RBMedia. (2020). Company. RBMedia. https://rbmediaglobal.com/company/ (Archived by the Internet Archive at https://bit.ly/3tB0OgM)

- Reid, C. (2016, February 26). Samhain Publishing to shut down operations. Publishers Weekly. https://bit.ly/3erqfNl (Archived by the Internet Archive at https://bit.ly/2QVfIBf)

- Reilly, P. (2015, February 24). Did Amazon sink the queen of online erotica? Vulture. https://www.vulture.com/2015/02/amazon-tina-engler-erotica.html. (Archived by the Internet Archive at https://bit.ly/3haKErD)

- Rubery, M. (2016). The untold story of the talking book. Harvard University Press.

- Sieghart, W. (2013). An independent review of e-lending in public libraries in England. U.K. Department of Culture, Media and Sport. https://bit.ly/3uBgQIQ (Archived by the Internet Archive at https://bit.ly/3h7LxBm)

- Statista. (2018). Australia: smartphone penetration 2012–2022. Statista. https://bit.ly/3b9LmBEhttps://bit.ly/3b9LmBE (Archived by the Internet Archive at https://bit.ly/3h7BpZn)

- Stern, C. (2011). The role of audiobooks in academic libraries. College & Undergraduate Libraries, 18(1), 77–91. https://doi.org/10.1080/10691316.2011.550532

- Stewart, D., Casey, M., & Wigginton, C. (2019, December 9). The rise of audiobooks and the podcast industry: TMT predictions 2020. Deloitte Insights. https://bit.ly/3txzIa6 (Archived by the Internet Archive at https://bit.ly/3eqPdfC)

- Thelwall, M. (2019). Reader and author gender and genre in Goodreads. Journal of Librarianship and Information Science, 51(2), 403–430. https://doi.org/10.1177%2F0961000617709061

- Wais, K. (2016). Gender prediction methods based on first names with Genderize. The R Journal, 8(1), 17–37. https://doi.org/10.32614/RJ-2016-002. https://journal.r-project.org/archive/2016/RJ-2016-002/RJ-2016-002.pdf (Archived by the Internet Archive at https://bit.ly/3vPjYRf)

- Wallin, E. T., & Nolin, J. (2020). Time to read: exploring the timespaces of subscription-based audiobooks. New Media & Society, 22(3), 470–488. https://doi.org/10.1177%2F1461444819864691

- Wood, H. (2018a, April 9). ‘Booming’ audiobook sales double in five years. The Bookseller. https://bit.ly/3hhdneF (Archived by the Internet Archive at https://bit.ly/33nfIwm)

- Wood, H. (2018b, April 4). Ulverscroft buys audiobook company Oakhill. The Bookseller. https://bit.ly/2RETAuz (Archived by the Internet Archive at https://bit.ly/3vOap5e

How to cite this paper

Appendix - Top 100 audiobook titles

| Title | Check- outs |

Author name |

Author sex |

Author nationality | First publication | Genre 1 |

Genre 2 |

Audience | Imprint |

|---|---|---|---|---|---|---|---|---|---|

| Beachcombers: A Novel | 1747 | Nancy Thayer | Female | American | 2010 | Fiction | Other | Adult | Tantor Media, Inc |

| Harry Potter and the Philosopher's Stone: Harry Potter Series, Book 1 | 1439 | J.K. Rowling | Female | British | 1997 | Fiction | Science Fiction and Fantasy | Children/YA | Pottermore |

| The Hunger Games: The Hunger Games Series, Book 1 | 1364 | Suzanne Collins | Female | American | 2008 | Fiction | Science Fiction and Fantasy | Children/YA | Scholastic Inc. Audiobooks |

| A Dedicated Man: Chief Inspector Banks Series, Book 2 | 1291 | Peter Robinson | Male | British/ Canadian |

1988 | Fiction | Crime | Adult | Tantor Media, Inc |

| The Devil's Feather: A Novel | 1166 | Minette Walters | Female | British | 2005 | Fiction | Crime | Adult | Tantor Media, Inc |

| Gallows View: Chief Inspector Banks Series, Book 1 | 1125 | Peter Robinson | Male | British/ Canadian |

1987 | Fiction | Crime | Adult | Tantor Media, Inc |

| Harry Potter and the Chamber of Secrets: Harry Potter Series, Book 2 | 1123 | J.K. Rowling | Female | British | 1998 | Fiction | Science Fiction and Fantasy | Children/YA | Pottermore |

| Harry Potter and the Prisoner of Azkaban: Harry Potter Series, Book 3 | 1091 | J.K. Rowling | Female | British | 1999 | Fiction | Science Fiction and Fantasy | Children/YA | Pottermore |

| Harry Potter and the Order of the Phoenix: Harry Potter Series, Book 5 | 1086 | J.K. Rowling | Female | British | 2003 | Fiction | Science Fiction and Fantasy | Children/YA | Pottermore |

| Harry Potter and the Goblet of Fire: Harry Potter Series, Book 4 | 1027 | J.K. Rowling | Female | British | 2000 | Fiction | Science Fiction and Fantasy | Children/YA | Pottermore |

| Final Account: Chief Inspector Banks Series, Book 7 | 958 | Peter Robinson | Male | British/ Canadian |

1994 | Fiction | Crime | Adult | Tantor Media, Inc |

| Harry Potter and the Deathly Hallows: Harry Potter Series, Book 7 | 955 | J.K. Rowling | Female | British | 2007 | Fiction | Science Fiction and Fantasy | Children/YA | Pottermore |

| Harry Potter and the Half-Blood Prince: Harry Potter Series, Book 6 | 954 | J.K. Rowling | Female | British | 2005 | Fiction | Science Fiction and Fantasy | Children/YA | Pottermore |

| A Necessary End: Chief Inspector Banks Series, Book 3 | 942 | Peter Robinson | Male | British/ Canadian |

1989 | Fiction | Crime | Adult | Tantor Media, Inc |

| Mockingjay: The Hunger Games Series, Book 3 | 923 | Suzanne Collins | Female | American | 2010 | Fiction | Science Fiction and Fantasy | Children/YA | Scholastic Inc. Audiobooks |

| Catching Fire: The Hunger Games Series, Book 2 | 865 | Suzanne Collins | Female | American | 2009 | Fiction | Science Fiction and Fantasy | Children/YA | Scholastic Inc. Audiobooks |

| The Hanging Valley: Chief Inspector Banks Series, Book 4 | 805 | Peter Robinson | Male | Britsh/ Canadian |

1989 | Fiction | Crime | Adult | Tantor Media, Inc |

| 12th of Never: Women's Murder Club Series, Book 12 | 799 | James Patterson | Collaboration | American | 2013 | Fiction | Crime | Adult | Blackstone Audio, Inc. |

| Death of an Artist: A Mystery | 792 | Kate Wilhelm | Female | American | 2012 | Fiction | Crime | Adult | Blackstone Audio, Inc. |

| Cause of Death: Kay Scarpetta Series, Book 7 | 741 | Patricia Cornwell | Female | American | 1996 | Fiction | Crime | Adult | Phoenix Books, Inc. |

| Beyond Seduction: Bastion Club Series, Book 6 | 704 | Stephanie Laurens | Female | Australian | 2007 | Fiction | Romance | Adult | Blackstone Audio, Inc. |

| The Fellowship of the Ring: The Lord of the Rings Series, Book 1 | 702 | J. R. R. Tolkien | Male | British | 1954 | Fiction | Science Fiction and Fantasy | Adult | Random House Group Limited |

| The Cold, Cold Ground: Detective Sean Duffy Series, Book 1 | 673 | Adrian McKinty | Male | British | 2012 | Fiction | Crime | Adult | Blackstone Audio, Inc. |

| The Hobbit | 673 | J. R. R. Tolkien | Male | British | 1937 | Fiction | Science Fiction and Fantasy | Adult | Random House Group Limited |

| American Sniper: The Autobiography of the Most Lethal Sniper in U.S. Military History | 655 | Chris Kyle | Male | American | 2012 | Non-fiction | Autobiography | Adult | HarperCollins Publishers Inc. |

| Past Reason Hated: Chief Inspector Banks Series, Book 5 | 655 | Peter Robinson | Male | British/ Canadian |

1991 | Fiction | Crime | Adult | Tantor Media, Inc |

| The Mysterious Affair at Styles: Hercule Poirot Series, Book 1 | 598 | Agatha Christie | Female | British | 1920 | Fiction | Crime | Adult | Tantor Media, Inc |

| Wednesday's Child: Chief Inspector Banks Series, Book 6 | 598 | Peter Robinson | Male | British/ Canadian |

1992 | Fiction | Crime | Adult | Tantor Media, Inc |

| Pros and Cons: Fox and O'Hare Series, Book 0.5 | 591 | Janet Evanovich | Collaboration | American | 2013 | Fiction | Crime | Adult | Books on Tape |

| A is for Alibi: Kinsey Millhone Series Book 1 | 591 | Sue Grafton | Female | American | 1982 | Fiction | Crime | Adult | Books on Tape |

| Wheat Belly: Lose the Wheat, Lose the Weight, and Find Your Path Back to Health | 582 | William Davis, MD | Male | American | 2011 | Non-fiction | Diet | Adult | Blackstone Audio, Inc. |

| The Secret Adversary: Tommy and Tuppence Series, Book 1 | 574 | Agatha Christie | Female | British | 1922 | Fiction | Crime | Adult | Blackstone Audio, Inc. |

| The Richest Season: A Novel | 563 | Maryann McFadden | Female | American | 2006 | Fiction | Other | Adult | Tantor Media, Inc |

| Stone Cold: Jesse Stone Series, Book 4 | 554 | Robert B. Parker | Male | American | 2003 | Fiction | Crime | Adult | Phoenix Books, Inc. |

| Fidelity | 540 | Thomas Perry | Male | American | 2008 | Fiction | Crime | Adult | Tantor Media, Inc |

| The Overlook: Harry Bosch Series, Book 13 | 539 | Michael Connelly | Male | American | 2007 | Fiction | Crime | Adult | Hachette Audio |

| A Brief History of Time | 535 | Stephen W. Hawking | Male | British | 1988 | Non-fiction | Science | Adult | Phoenix Books, Inc. |

| The Devil of Nanking | 528 | Mo Hayder | Female | British | 2004 | Fiction | Crime | Adult | Tantor Media, Inc |

| Winter King: The Dawn of Tudor England | 516 | Thomas Penn | Male | British | 2011 | Non-fiction | History | Adult | Blackstone Audio, Inc. |

| Meditations to Change Your Brain | 516 | Rick Hanson | Male | American | 2009 | Non-fiction | Self-help | Adult | Sounds True, Inc |

| The Time Traveler's Wife | 514 | Audrey Niffenegger | Female | American | 2003 | Fiction | Science Fiction and Fantasy | Adult | HighBridge Company |

| Anna Karenina | 512 | Leo Tolstoy | Male | Russian | 1878 | Fiction | Other | Adult | Blackstone Audio, Inc. |

| A Bit on the Side: Stories | 500 | William Trevor | Male | Irish | 2004 | Fiction | Short story collection | Adult | Tantor Media, Inc |

| The Wonderful Wizard of Oz: Oz Series, Book 1 | 495 | L. Frank Baum | Male | American | 1900 | Fiction | Science Fiction and Fantasy | Children/YA | Tantor Media, Inc |

| Open And Shut: Andy Carpenter Series, Book 1 | 493 | David Rosenfelt | Male | American | 2002 | Fiction | Crime | Adult | Listen & Live Audio, Inc. |

| The Last Secret | 493 | Mary McGarry Morris | Female | American | 2009 | Fiction | Crime | Adult | Tantor Media, Inc |

| A Taste for Murder: Hemlock Falls Mystery Series, Book 1 | 485 | Claudia Bishop | Female | American | 1994 | Fiction | Crime | Adult | Blackstone Audio, Inc. |

| The Two Towers: The Lord of the Rings Series, Book 2 | 474 | J. R. R. Tolkien | Male | British | 1954 | Fiction | Science Fiction and Fantasy | Adult | Random House Group Limited |

| Fahrenheit 451 | 470 | Ray Bradbury | Male | American | 1953 | Fiction | Science Fiction and Fantasy | Adult | Tantor Media, Inc |

| Still Alice | 467 | Lisa Genova | Female | American | 2007 | Fiction | Other | Adult | HighBridge Company |

| A Prison Diary | 460 | Jeffrey Archer | Male | British | 2002 | Non-fiction | Autobiography | Adult | Phoenix Books, Inc. |

| The Shell Game: Fox and O'Hare Series, Book 0.25 | 457 | Janet Evanovich | Collaboration | American | 2014 | Fiction | Crime | Adult | Books on Tape |

| Echo Park: Harry Bosch Series, Book 12 | 454 | Michael Connelly | Male | American | 2006 | Fiction | Crime | Adult | Hachette Audio |

| A Wife for Big John | 451 | Lauri Robinson | Female | American | 2008 | Fiction | Romance | Adult | Tantor Media, Inc |

| Atonement | 446 | Ian McEwan | Male | British | 2001 | Fiction | Other | Adult | Phoenix Books, Inc. |

| Miss Peregrine's Home for Peculiar Children: Miss Peregrine Series, Book 1 | 446 | Ransom Riggs | Male | American | 2011 | Fiction | Science Fiction and Fantasy | Children/YA | Books on Tape |

| Mr. Churchill's Secretary: Maggie Hope Series, Book 1 | 439 | Susan Elia MacNeal | Female | American | 2012 | Fiction | Crime | Adult | Books on Tape |

| B is for Burglar: Kinsey Millhone Series Book 2 | 437 | Sue Grafton | Female | American | 1985 | Fiction | Crime | Adult | Books on Tape |

| The Bonesetter's Daughter | 437 | Amy Tan | Female | American | 2001 | Fiction | Other | Adult | Phoenix Books, Inc. |

| Heartburn | 436 | Nora Ephron | Female | American | 1983 | Fiction | Other | Adult | Books on Tape |

| The Maze of Bones: The 39 Clues Series, Book 1 | 436 | Rick Riordan | Male | American | 2008 | Fiction | Science Fiction and Fantasy | Children/YA | Scholastic Inc. Audiobooks |

| The Power of Now: A Guide to Spiritual Enlightenment | 435 | Eckhart Tolle | Male | German | 1997 | Non-fiction | Self-help | Adult | New World Library |

| The Friday Night Knitting Club: The Friday Night Knitting Club Series, Book 1 | 434 | Kate Jacobs | Female | Canadian | 2006 | Fiction | Other | Adult | Oakhill Publishing Limited |

| C is for Corpse: Kinsey Millhone Series Book 3 | 433 | Sue Grafton | Female | American | 1986 | Fiction | Crime | Adult | Books on Tape |

| War Horse: War Horse Series, Book 1 | 428 | Michael Morpurgo | Male | British | 1982 | Fiction | Adventure | Children/YA | Scholastic Inc. Audiobooks |

| The Inimitable Jeeves | 428 | P. G. Wodehouse | Male | British | 1923 | Fiction | Humour | Adult | Blackstone Audio, Inc. |

| Big Girl Panties: A Novel | 424 | Stephanie Evanovich | Female | American | 2013 | Fiction | Romance | Adult | HarperCollins Publishers Inc. |

| Firewall: Kurt Wallander Series, Book 8 | 419 | Henning Mankell | Male | Swedish | 1998 | Fiction | Crime | Adult | Blackstone Audio, Inc. |

| Out of the Black Land | 416 | Kerry Greenwood | Female | Australian | 2010 | Fiction | Other | Adult | Blackstone Audio, Inc. |

| Dirk Gently's Holistic Detective Agency: Dirk Gently Series, Book 1 | 410 | Douglas Adams | Male | British | 1987 | Fiction | Crime | Adult | Random House Group Limited |

| Along Came a Spider: Alex Cross Series, Book 1 | 405 | James Patterson | Male | American | 1993 | Fiction | Crime | Adult | Blackstone Audio, Inc. |

| All Cry Chaos: Henri Poincare Series, Book 1 | 401 | Leonard Rosen | Male | American | 2010 | Fiction | Crime | Adult | Blackstone Audio, Inc. |

| A Darkness More Than Night: Harry Bosch Series, Book 7 | 401 | Michael Connelly | Male | American | 2001 | Fiction | Crime | Adult | Hachette Audio |

| Slummy Mummy: The Secret Life of Lucy Sweeney | 400 | Fiona Neill | Female | British | 2007 | Fiction | Other | Adult | Listen & Live Audio, Inc. |

| 1st to Die: Women's Murder Club Series, Book 1 | 395 | James Patterson | Male | American | 2001 | Fiction | Crime | Adult | Hachette Audio |

| A Whole New Light | 395 | Sandra Brown | Female | American | 1989 | Fiction | Romance | Adult | Books on Tape |

| Birds of Prey: The Courtney Family, The Third Sequence Series, Book 1 | 392 | Wilbur Smith | Male | British | 1997 | Fiction | Other | Adult | Phoenix Books, Inc. |

| Brave New World | 390 | Aldous Huxley | Male | British | 1932 | Fiction | Science Fiction and Fantasy | Adult | Blackstone Audio, Inc. |

| The Beautiful Mystery: Chief Inspector Armand Gamache Series, Book 8 | 388 | Louise Penny | Female | Canadian | 2012 | Fiction | Crime | Adult | Macmillan Audio |

| The Secret Adversary: Tommy and Tuppence Series, Book 1 | 388 | Agatha Christie | Female | British | 1922 | Fiction | Crime | Adult | Tantor Media, Inc |

| Legend of the Guardians: The Owls of Ga'Hoole: Guardians of Ga'Hoole Series, Books 1 - 3 | 387 | Kathryn Lasky | Female | American | 2002 | Fiction | Science Fiction and Fantasy | Children/YA | Blackstone Audio, Inc. |

| Eragon: Inheritance Cycle, Book 1 | 386 | Christopher Paolini | Male | American | 2002 | Fiction | Science Fiction and Fantasy | Children/YA | Books on Tape |

| Sisters | 383 | Danielle Steel | Female | American | 2007 | Fiction | Other | Adult | Books on Tape |

| Dead by Midnight: Dead by Trilogy, Book 1 | 380 | Beverly Barton | Female | American | 2010 | Fiction | Romance | Adult | Blackstone Audio, Inc. |

| The Return of the King: The Lord of the Rings Series, Book 3 | 379 | J. R. R. Tolkien | Male | British | 1955 | Fiction | Science Fiction and Fantasy | Adult | Random House Group Limited |

| Agatha Raisin and the Murderous Marriage: Agatha Raisin Mystery Series, Book 5 | 377 | M. C. Beaton | Female | British | 1996 | Fiction | Crime | Adult | Random House Group Limited |

| Love in the Time of Cholera | 371 | Gabriel Garcia Marqu | Male | Colombian | 1985 | Fiction | Other | Adult | Blackstone Audio, Inc. |

| Never Have Your Dog Stuffed: And Other Things I've Learned | 365 | Alan Alda | Male | American | 2005 | Non-fiction | Autobiography | Adult | Books on Tape |

| The Curious Curate & The Buried Treasure | 362 | M. C. Beaton | Female | British | 2003 | Fiction | Crime | Adult | Random House Group Limited |

| Magic Bites: Kate Daniels Series, Book 1 | 362 | Ilona Andrews | Collaboration | American | 2007 | Fiction | Science Fiction and Fantasy | Adult | Tantor Media, Inc |

| The Great Gatsby | 356 | F. Scott Fitzgerald | Male | American | 1925 | Fiction | Other | Adult | Naxos of America, Inc. |

| Storm Front: The Dresden Files Series, Book 1 | 355 | Jim Butcher | Male | American | 2000 | Fiction | Science Fiction and Fantasy | Adult | Buzzy Multimedia |

| The Affair: Jack Reacher Series, Book 16 | 354 | Lee Child | Male | British | 2011 | Fiction | Crime | Adult | Random House Group Limited |

| The Road | 354 | Cormac McCarthy | Male | American | 2006 | Fiction | Science Fiction and Fantasy | Adult | Naxos of America, Inc. |

| 9th Judgement: Women's Murder Club Series, Book 9 | 352 | James Patterson | Male | American | 2010 | Fiction | Crime | Adult | Random House Group Limited |

| Water for Elephants | 352 | Sara Gruen | Female | Canadian | 2006 | Fiction | Other | Adult | HighBridge Company |

| Blindsighted: Grant County Series, Book 1 | 351 | Karin Slaughter | Female | American | 2001 | Fiction | Crime | Adult | HarperCollins Publishers Inc. |

| Three Men in a Boat: (To Say Nothing of the Dog): Three Men in a Boat Series, Book 1 | 351 | Jerome K. Jerome | Male | British | 1889 | Fiction | Humour | Adult | Tantor Media, Inc |

| Beat Until Stiff: Mary Ryan, Pastry Chef Mystery Series, Book 1 | 350 | Claire M. Johnson | Female | American | 2002 | Fiction | Crime | Adult | Blackstone Audio, Inc. |

| The Fullness of Time | 349 | Kate Wilhelm | Female | American | 2012 | Fiction | Science Fiction and Fantasy | Adult | Blackstone Audio, Inc. |